- Corporate Governance

- 1 Group structure and shareholder base

- 2 Capital structure

- 3 Board of Directors

- 4 Group Management

- 5 Compensation, shareholdings, and loans

- 6 Shareholders’participation

- 7 Change of control and defence measures

- 8 Statutory auditors

- 9 Information policy

Corporate Governance

1Group structure and shareholder base

1.1Group structure

1.1.1Operational Group structure

As of 31 December 2020, the operational Group structure of Arbonia AG comprises (1) the HVAC Division, (2) the Sanitary Equipment Division, (3) the Windows Division, and (4) the Doors Division (see divisional structure page 13). Together with the Finance/Controlling/Reporting area, the four divisions form the Group's operational structure as of 31 December 2020.

As of 31 December 2020, Arbonia Group Management comprises the interim CEO, the CFO, and the heads of the four divisions (1) HVAC, (2) Sanitary Equipment, (3) Windows, and (4) Doors. Group Management is supported by Corporate Functions.

The company reports in line with IFRS on the basis of the above divisional structure. Descriptions of the divisions as of 31 December 2020 are found on pages 14 – 45.

Arbonia AG announced on 5 January 2021 that it will sell its window business to the Danish DOVISTA Group. The transaction is subject to the required approval by the responsible competition authorities. The closing of the contract is expected in the second quarter of 2021.

After the closing of the above-mentioned sale of the windows business, the operational group structure of Arbonia AG will comprise (1) the HVAC Division, (2) the Sanitary Equipment Division, and (3) the Doors Division. As of that date, Arbonia Group Management will comprise the interim CEO, the CFO, as well as the heads of the three divisions (1) HVAC, (2) Sanitary Equipment, and (3) Doors.

Arbonia announced on 2 March 2021 that it will integrate the Sanitary Equipment Division into the Doors Division as of 1 July 2021. As of 1 July 2021, the operational group structure of Arbonia AG comprises (1) the HVAC Division with the Heating Technology Business Unit as well as the Ventilation and Air Conditioning Business Unit, and (2) the Doors Division with the Wood Solutions Business Unit as well as the Glass Solutions Business Unit (see the divisional structure on page 13). As of 1 July 2021, Arbonia Group Management will consist of the interim CEO, the CFO, and the heads of the two divisions (1) HVAC and (2) Doors.

Arbonia AG announced on 2 March 2021 that a new holding organisation will be introduced as of the Annual General Meeting on 22 April 2022. The previous organisation, in which the Chairman of the Board of Directors also holds the position of interim CEO, will be replaced by a holding structure without a dual mandate. As of the Annual General Meeting on 22 April 2022, the organisation of the Arbonia Group forsees an Executive Chairman of the Board of Directors and a CFO, who will be Head of Corporate Functions at the same time. As of that date, Group Management will consist of the CFO and (subject to the completion of the sale of the windows business) the heads of the two divisions (1) HVAC and (2) Doors.

1.1.2Scope of consolidation

The scope of consolidation of Arbonia AG, headquartered in Arbon TG ("Arbonia" or the "company") comprises the Group companies listed in the financial report on page 187 (collectively the "Group"). The name, registered office and share capital of the main Group companies, as well as the interests held by the Group, are also detailed on these pages. Arbonia shares are listed at the SIX Swiss Exchange in Zurich under securities number 11 024 060 (ISIN CH0110240600). Information about market capitalisation can be found in the Supplementary Information for Investors on page 215. Other than Arbonia, none of the other Group companies included in the scope of consolidation are listed at any stock exchange in Switzerland or abroad.

1.2Major shareholders

On 17 December 2016, Artemis Beteiligungen I AG, which is controlled by Michael Pieper, reported a shareholding of 20.02% (www.six-exchange-regulation.com/en/home/publications/significant-shareholders.html). As of 31 December 2020, the shareholding of Artemis Beteiligungen I AG amounted to 22.09%.

On 4 February 2020, Morgan Stanley reported a shareholding (securities lending) of 5.06% and on 13 February 2020 a shareholding of 0.0005% (www.six-exchange-regulation.com/en/home /publications/significant-shareholders.html).

On 18 June 2020 M&G Plc reported a shareholding of 3.16% (www.six-exchange-regulation.com/en/home/publications/significant-shareholders.html).

On 29 October 2020 Credit Suisse Funds AG reported a shareholding of 3.04%, and on 18 December 2020 Credit Suisse Funds AG reported a shareholding of 2.98% (www.six-exchange-regulation.com/en/home/publications/significant-shareholders.html).

Arbonia is not aware of any shareholders' agreements among its shareholders.

1.3Cross-shareholdings

No cross-shareholdings of more than 5% of the votes or the capital exist between Arbonia and other companies.

2Capital structure

2.1Capital

As of 31 December 2020, the ordinary capital of Arbonia is CHF 291 787 620.60, the conditional capital is CHF 29 148 000.00, and the authorised capital is also CHF 29 148 000.00.

The ordinary capital results from note 48 of the annex to the consolidated financial statement on page 174.

2.2Authorised and conditional capital

Authorised capital

The General Meeting on 24 April 2020 authorised the Board of Directors to increase the share capital by a maximum of CHF 29 148 000 by issuing a maximum of 6 940 000 fully paid-up registered shares of a par value of CHF 4.20 each at any time until 24 April 2022.

No changes related to the authorised capital took place in 2020 (see section 2.3).

In certain circumstances, the Board of Directors can exclude in whole or parts the preferential subscription right of shareholders in favour of third parties. Shares can be issued in one or multiple stages.

The authorised and conditional capital are available on an alternative instead of a cumulative basis. If new shares are issued based on the authorised capital, the conditional capital shall also decrease by the same amount as the authorised capital.

Conditional capital

The share capital can be increased by a maximum of CHF 29 148 000 by issuing a maximum of 6 940 000 fully paid-up registered shares with a nominal value of CHF 4.20 each. These registered shares are to be issued upon exercise of option rights granted in conjunction with convertible bonds, bonds with option rights or similar forms of financing offered by Arbonia or one of its subsidiaries. Shareholders' subscription rights are excluded.

If new shares are issued based on the conditional capital, the authorised capital shall also decrease by the same amount as the conditional capital.

Group of beneficiaries, conditions, and modalities

The group of beneficiaries and the terms and conditions for issuing shares from the authorised and conditional capital are described in Art. 3a and Art. 3b of the Articles of Association (available at www.arbonia.com/en/company/corporate-governance).

2.3Changes in capital

In the last three reporting years (2018 – 2020), the share capital of CHF 291 787 620.60, which is fully paid-up and divided into 69 473 243 registered shares of a nominal value of CHF 4.20 each, remained unchanged.

2.4Shares and participation certificates

The company has issued 69 473 243 registered shares at a nominal value of CHF 4.20. Each registered share grants the same entitlement to receive dividends and represents one vote at the General Meeting. No preferential rights have been granted. The company has not issued any participation certificates.

2.5Dividend right certificates

The company has not issued any dividend right certificates.

2.6Limitations on transferability and nominee registrations

2.6.1Limitations on transferability

On request, purchasers and beneficiaries of registered shares are registered in the share register as shareholders with voting rights if they expressly declare that they have purchased the shares in their own name and for their own account.

2.6.2Granting of exceptions

The company's Articles of Association do not permit any exceptions to the rules described above in 2.6.1. Accordingly, the Board of Directors did not grant any exceptions in the reporting year.

2.6.3Nominee registrations

Nominees are persons who, on applying for registration, do not explicitly declare that they hold the shares for their own account and with whom the Board of Directors has signed an agreement to this effect. As a matter of principle, a nominee is not entered in the share register with voting rights for more than 3% of the registered share capital entered in the Commercial Register. Beyond this limit, a nominee is only entered in the share register with voting rights insofar as he or she discloses the names, addresses and shareholdings of the persons for whose account he or she holds 0.5% or more of the registered share capital entered in the share register. In the event of such a disclosure, the nominee concerned is entered in the share register with voting rights up to a maximum of 8% of the registered share capital entered in the Commercial Register.

2.6.4Procedure and requirements for limitations on transferability

Under Art. 13 of the Articles of Association (www.arbonia.com/en/company/corporate-governance), limitations on the transferability of registered shares require the approval of at least two thirds of the voting shares represented and the absolute majority of the nominal share value represented.

2.7Convertible bonds and options

There are no outstanding convertible bonds or options issued by Arbonia.

3Board of Directors

The Board of Directors of Arbonia consists of experts who cover the key subject areas of Arbonia as a building components supplier. The Board of Directors attaches due importance to the diversity of the body, reflecting one of the Group's corporate principles. When positions on the Board of Directors are filled in the future, women will be included in the list of potential nominations.

3.1Members of the Board of Directors

As of 31 December 2020, the Board of Directors consisted of the following members:

Alexander von Witzleben

1963, German citizen, resident in Erlenbach ZH, degree in business management, from 17 April 2015 to 30 June 2015 Chairman of the Board of Directors and, since 1 July 2015, Chairman and Delegate of the Board of Directors. 1990–1993 KPMG Deutsche Treuhand Gesellschaft, Munich (D); 1993–1995 Head of Central Finance/Controlling JENOPTIK AG, Jena (D); 1996–2003 member of the Board of Directors, CFO, JENOPTIK AG, Jena (D); 2003–2007 Chairman of the Board of Directors, CEO, JENOPTIK AG, Jena (D); 2007–2008 member of the Board of Directors of Franz Haniel&Cie. GmbH, Duisburg (D); since 2009 Chairman of the Board of Directors at Feintool International Holding AG, Lyss and interim CEO in 2009. Alexander von Witzleben has been a member of the Board of Directors of Artemis Holding AG, Hergiswil, since 20 May 2015. This company has a shareholding of 22.09% in Arbonia and a shareholding of 50.32% in Feintool International Holding AG, Lyss. Alexander von Witzleben has been a member of the executive management of Arbonia on an interim basis since 1 July 2015. Aside from this, he has no material business relationships with Arbonia or its subsidiaries.

Other activities and vested interests: Member of the Advisory Board of KAEFER Isoliertechnik GmbH&Co. KG, Bremen (D); Chairman of the Supervisory Board of PVA TePla AG, Wettenberg (D); Chairman of the Supervisory Board of VERBIO Vereinigte BioEnergie AG, Leipzig (D); member of the Supervisory Board of Siegwerk Druckfarben AG&Co. KGaA, Siegburg (D); member of the Board of Directors of Artemis Holding AG, Hergiswil NW; Chairman of the Board of Directors of Feintool International Holding AG, Lyss BE.

Peter Barandun

1964, Swiss citizen, resident in Einsiedeln SZ, Executive MBA HSG, non-executive Vice-Chairman of the Board of Directors since 17 April 2015 (2014-2015 non-executive Member of the Board of Directors). 1985–1990 Deputy Head of Sales at Grossenbacher AG, St. Gallen; 1990–1995 Head of Sales Eastern Switzerland at Bauknecht AG, Lenzburg; 1995–1996 Head of Sales Switzerland/member of the management of Bauknecht AG, Lenzburg; 1996–2002 Director of the divisions Electrolux and Zanussi Electrolux AG, Zurich; since 2002 CEO Electrolux Switzerland/Chairman of the Board of Directors of Electrolux AG, Zurich. Peter Barandun has never been part of the executive management of Arbonia or its subsidiaries. He has no material business relationships with Arbonia or its subsidiaries.

Other activities and vested interests: Chairman of the Board of Directors of Electrolux Holding AG, Zurich ZH, and of Electrolux AG, Zurich ZH; Vice-Chairman of FEA (Swiss Association of the Domestic and Industrial Electrical Appliances), Zurich ZH; Vice-Chairman of the Board of Swiss Ski, Muri near Bern BE; member of the Board of Directors of Fundamenta Group Holding AG, Zug ZG; member of the Supervisory Board of Fundamenta Group (Deutschland) AG, Munich (D).

Peter E. Bodmer

1964, Swiss citizen, resident in Küsnacht ZH, lic. oec. publ., Executive MBA, IMD, non-executive member of the Board of Directors since 19 April 2013. 1993–1994 Head of Sales at Kaiser Precision Tooling Ltd., Rümlang; 1995–1998 Deputy Director, Head of Integration and CFO Europe at GKN Sinter Metals GmbH; 1998–2005 COO and CFO of Maag Holding AG; 2005–2012 member of Group Management at the Implenia Group; since 2011 various management and consulting mandates as Chairman and CEO of the BEKA Group. Peter E. Bodmer has never been part of the executive management of Arbonia or its subsidiaries. He has no material business relationships with Arbonia or its subsidiaries.

Other activities and vested interests: member of the Board of Directors of Peach Property Group AG, Zurich ZH; member of the Board of Directors of Kuratle Group AG, Leibstadt AG; member of the Board of Directors of Brütsch/Rüegger Holding AG, Urdorf ZH; Vice-Chairman of the Board of Directors of Helvetica Property Investors AG, Zurich ZH; member of the Board of Directors of INOVETICA Holding AG, Baar ZG; president of the Foundation Board of Zurich Innovation Park, Dübendorf ZH; president of the Foundation Board of Profond Pension Fund, Zurich ZH; member of the Foundation Board of the Wilhelm Schulthess-Stiftung, Zurich ZH; member of the Board of Directors of Klinik Schloss Mammern AG, Mammern TG; member of the Board of Directors of Nüssli (Schweiz) AG, Hüttwilen TG, active as an advisor for various companies, whereby his activities as an advisor do not present any conflict of interest with the Arbonia Group.

Markus Oppliger

1959, Swiss citizen, resident in Wangs SG, accounting and controlling expert with a federal diploma, auditor with a federal diploma, non-executive member of the Board of Directors since 19 April 2013. 1978–1983 Prefera Treuhandgesellschaft Sargans; 1983–1988 Bank in Liechtenstein/Prince of Liechtenstein Foundation; 1989–2013 at Ernst&Young, partner from 1996 and Quality&Risk Management Leader of the Advisory Services of Ernst&Young GSA (Germany, Switzerland, Austria) from 2009; various consulting mandates as an independent management consultant and owner of Oppliger Management Consulting since 2013. Markus Oppliger has never been part of the executive management of Arbonia or its subsidiaries. He has no material business relationships with Arbonia or its subsidiaries.

Other activities and vested interests: Chairman of the Board of Directors of Siga Ausstellung AG, Mels SG; Chairman of the Board of Directors of Pizolbahnen AG, Bad Ragaz SG; Member of the Foundation Board of Stiftung Pizol mit Herz, Vilters-Wangs SG; judge at the commercial court in the Canton of St. Gallen, term of office 2017/2023; member of the Board of Directors of St. Gallisch-Appenzellische Kraftwerke AG, St. Gallen SG; member of the Board of Directors of Songwon Industrial Co. Ltd., Ulsan, South Korea; active as an advisor for various companies, whereby his activities as an advisor do not present any conflicts of interest with the Arbonia Group.

Heinz Haller

1955, Swiss citizen, resident in Andermatt UR, MBA IMD, Lausanne, non-executive member of the Board of Directors since 25 April 2014. 1980–1994 various management positions in The Dow Chemical Company, Horgen/Frankfurt (D) / Midland MI (USA); 1994–1999 Managing Director of Plüss-Staufer AG, Oftringen; 2000–2001 Chief Executive Officer of Red Bull Sauber AG/Sauber Petronas Engineering AG, Hinwil; 2002–2006 Managing Director of Allianz Capital Partners GmbH, Munich (D); 2006–2010 Executive Vice-President Performance Products and Systems Divisions and DAS (Dow Agricultural Science Division) of The Dow Chemical Company, Midland MI (USA); 2010–2012 Executive Vice-President & Chief Commercial Officer of The Dow Chemical Company, Midland MI (USA); 2012–2018 Executive Vice-President of The Dow Chemical Company, President Dow Europe, Middle East, Africa & India (EMEAI). Heinz Haller has never been part of the executive management of Arbonia or its subsidiaries. He has no material business relationships with Arbonia or its subsidiaries.

Other activities and vested interests: member of the Board of Directors of South Pole Holding AG, Zurich ZH; member of the Board of Directors at Limmat Wealth AG, Zurich ZH; member of the Foundation Board of Zurich Innovation Park, Dübendorf ZH; chairman of the Board of Directors of GETEC PARK.SWISS AG, Muttenz BL; member of the Board of Directors of the Hockey Club Ambri Piotta SA, Quinto TI.

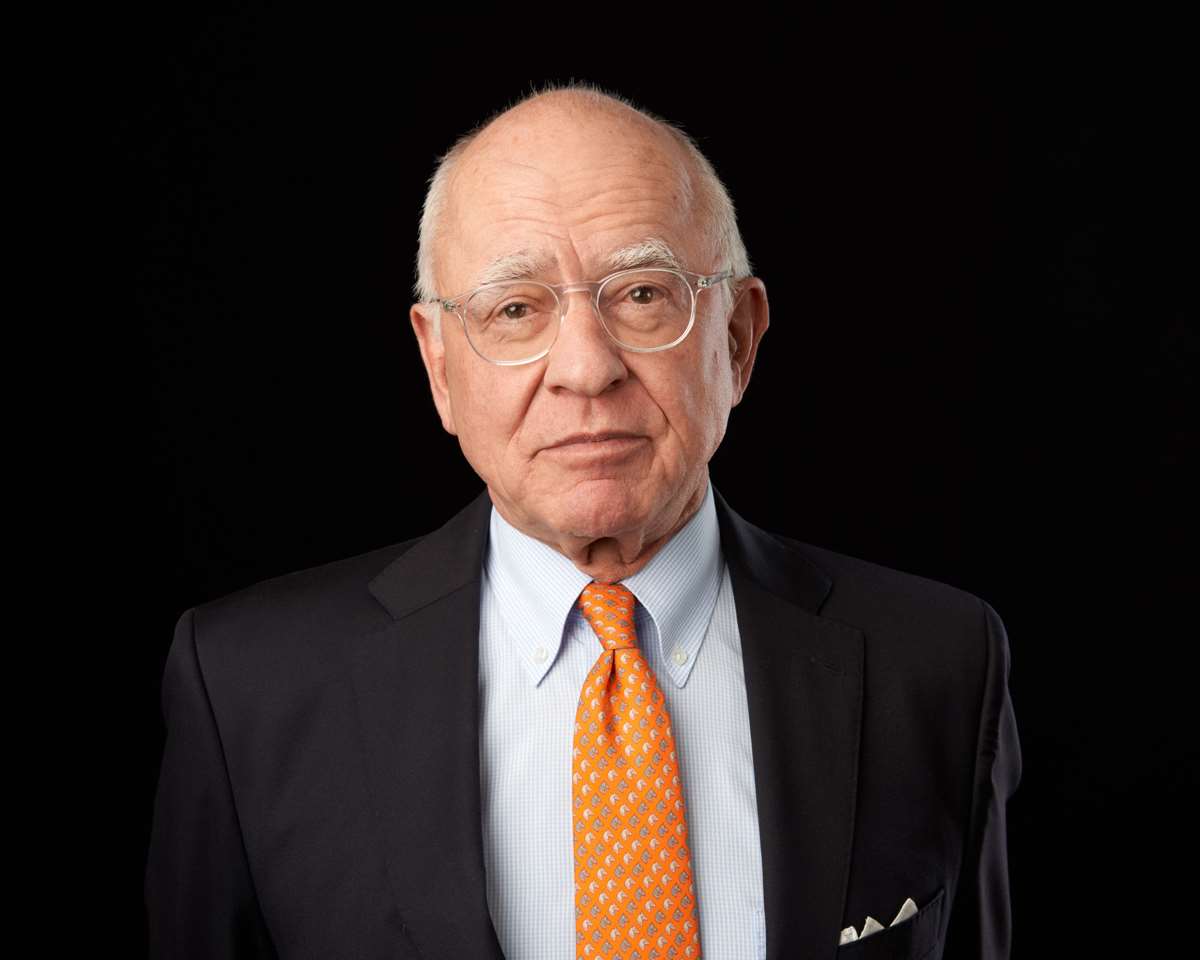

Michael Pieper

1946, Swiss citizen, resident in Hergiswil NW, lic. oec. HSG, non-executive member of the Board of Directors since 17 April 2015. Owner and CEO of the Franke/ Artemis Group since 1989; 1989–2012 CEO of the Franke Group, CEO of the Artemis Group since 2013. Michael Pieper has never been part of the executive management of Arbonia or its subsidiaries. Michael Pieper controls the largest shareholder in Arbonia (see 1.2) and, through companies under his ownership, has material business relationships with Arbonia subsidiaries (see pages 185/186).

Other activities and vested interests: member of the Board of Directors of Franke Holding AG, Aarburg AG (CH); member of the Board of Directors of BERGOS AG (previously BERGOS BERENBERG AG), Zurich ZH; Vice-Chairman of the Board of Directors of Forbo Holding AG, Baar ZG; member of the Board of Directors of Rieter Holding AG, Winterthur ZH; member of the Board of Directors of Autoneum Holding AG; Winterthur ZH, member of the Board of Directors of Reppisch-Werke AG, Dietikon ZH.

Thomas Lozser

1961, Swiss and US citizen, resident in Novi, Michigan (USA), degree in engineering from ETH, MBA, nonexecutive member of the Board of Directors since 13 December 2016. 1987–1988 Quality Assurance Assistant, Elco, Vilters; 1988–1989 Manufacturing Engineer, MPI International, Deerfield, Wisconsin (USA); 1989–1992 Assistant to the President and Manager Computer Systems, MPI International, Rochester Hill, Michigan (USA); 1992–1998 General Manager and President/Plant Manager, Kautex Textron, Avilla, Indiana (USA); 1998–2000 Senior Vice President Operations, Kautex Textron, Troy, Michigan (USA); 2000–2002 President and shareholder, Magnetic USA Inc., Olney Illinois (USA); following the takeover by SKF USA Inc. 2002–2005 Vice President Sales Lineartechnik, SKF USA Inc. Bethlehem, Pennsylvania (USA); 2005–2010 CEO of the Coatings business unit at the former Looser Group, Arbon; independent entrepreneur since 2010. Thomas Lozser has never been part of the executive management of Arbonia. He has no material business relationships with Arbonia or its subsidiaries.

Other activities and vested interests: member of the Board of Directors of Mopec Inc., Oak Park, Michigan (USA).

Dr. Carsten Voigtländer

1963, German citizen, resident in Mühbrook (D), graduate in mechanical engineering, Dr. Ing. process engineering, INSEAD Advanced Management Programme, non-executive member of the Board of Directors since 12 April 2019. 1989–1994 research assistant at the Institut für Thermodynamik of the Technische Universität Braunschweig (D), 1994–2002 various management positions at Neumag GmbH, Neumünster (D): 1994–1996 development engineer, 1996–1998 Head of the Engineering and Project Management Department, 1998–2000 Managing Director Technology, 2000–2002 spokesman of the management board for Technology, Service, commercial areas; 2002–2006 CEO and member of the management board at Saurer GmbH & Co. KG, Neumünster (D); 2006–2009 CEO and member of expanded Group Management OC Oerlikon AG and chairman of the management board of Oerlikon Textile GmbH & Co. KG, Remscheid (D); 2009–2018 various management positions at Vaillant GmbH, Remscheid (D): 2009–2010 CTO and Managing Director, 2011–2018 CEO and chairman of the management board and director of the Sales, Marketing and Service areas (2011–2015). Since 2018 various consultancy, administration and supervisory board mandates as well as owner of Voigtländer Board Advisory, Mühbrook (D). Dr Carsten Voigtländer has never been part of the executive management of Arbonia or its subsidiaries. He has no material business relationships with Arbonia or its subsidiaries.

Further activities and vested interests: Vice-Chairman of the Board of Directors of Saurer Intelligent Technology Co. Ltd., Shanghai (CN); member of the Board of Directors of Behr Bircher Cellpack BBC AG, Villmergen AG; Senior Advisor of INNIO Jenbacher GmbH & Co. OG, Jenbach (AT); member of the Board of Directors of Electrolux Professional AB, Ljungby (SE); member of the Foundation Board of Friedhelm Loh Stiftung & Co. KG, Haiger (D); member of the advisory board of STAR Deutschland GmbH, Sindelfingen (D); member of the Board of Directors of Stulz Verwaltungsgesellschaft mbH, Hamburg (D); member of the board of Modern Electron Inc., Bothell (USA); member of the advisory board of Future Carbon GmbH, Bayreuth (D); active as an advisor for various companies, whereby his activity as an advisor does not present any conflict of interest with the Arbonia Group.

3.2Number of permissible mandates pursuant to Art. 12 para. 1 section 1 of the Swiss Ordinance Against Excessive Compensation (OaEC)

Members of the Board of Directors may have a maximum of ten mandates outside the Group, of which no more than five may be with listed companies. This rule also applies for members of the Board of Directors who, at the same time, belong to Group Management by assuming the role of a delegate of the Board of Directors and interim CEO. More details on the rules for the number of permitted mandates can be found in Art. 29 of the Articles of Association (www.arbonia.com/en/company/corporate-governance).

3.3Election and term of office

The Chairman of the Board of Directors and the other members of the Board of Directors are individually elected by the Annual General Meeting for a term of office of one year. The members of the Board of Directors may be re-elected. The terms of office of the current members of the Board of Directors are as follows:

* The election took place on 1 November 2016 and the assumption of office took place on 13 December 2016.

3.4Internal organisation

3.4.1Allocation of tasks within the Board of Directors

The Chairman of the Board of Directors is Alexander von Witzleben and the Vice-Chairman is Peter Barandun. Since Alexander von Witzleben was appointed delegate of the Board of Directors and interim CEO on 1 July 2015, Markus Oppliger has been acting as Lead Director. The Board of Directors is supported by an Audit Committee and a Nomination and Compensation Committee.

3.4.2Committees of the Board of Directors

The duties, responsibilities and working procedures of the committees are laid down in the by-laws (www.arbonia.com/en/company/organisation). The Board of Directors appoints the members of the committees, with the exception of the Compensation Committee, whose members are elected by the General Meeting. The chairpersons of the committees are appointed by the Board of Directors.

3.4.2.1Audit Committee

The Audit Committee is convened by the Chairperson as often as business requires, but at least three times a year. It consists of three members. Two members of the Audit Committee are non-executive and independent. Alexander von Witzleben, member of the Audit Committee, was appointed delegate of the Board of Directors and interim CEO on 1 July 2015. All members of the Audit Committee have experience in finance and accounting.

The Audit Committee reviews the effectiveness of the external and internal auditors, the internal control system including risk management, the compliance with standards from a financial and legal perspective, the accounting system, the financial reports and the performance, fees and independence of the external auditors. It draws up a recommendation to the Board of Directors regarding the submission of the financial statements to the General Meeting. Within the scope of these duties, the Audit Committee has comprehensive rights of inspection and information. It may order investigations and consult external advisors.

Reporting to the Audit Committee is Internal Audit, which performs an independent, Group-wide auditing and monitoring role (see 3.6 below). The Audit Committee is authorised to make decisions regarding the tasks entrusted to it provided that the respective matter does not concern a non-delegable duty of the Board of Directors pursuant to Art. 716a of the Swiss Code of Obligations. The committee may submit issues within the scope of its decision-making powers to the Board of Directors.

The committee consists of the following members:

- Markus Oppliger, Chairman

- Alexander von Witzleben

- Peter E. Bodmer

The Audit Committee met four times during the reporting year. Of these, one meeting was held as a telephone conference and one meeting as a video conference. The interim CEO and the CFO attended all four meetings, and the external and internal auditors attended three meetings. At the subsequent meeting of all members of the Board of Directors, the Chairman reports on the meetings of the Audit Committee. The meetings of the Audit Committee lasted two and a half hours on average. The Chairman of the Audit Committee and the Head of Internal Audit regularly held additional meetings to discuss the findings of Internal Audit and its duties in detail. In the reporting year, the Audit Committee dealt with, among others, the effects of the COVID-19 pandemic on the course of business as well as the key financial figures, which served as the basis for the extraordinary reporting of the Arbonia Group in the reporting year.

3.4.2.2Nomination and Compensation Committee

The members of the Compensation Committee were elected by the General Meeting on 24 April 2020. The members of the Compensation Committee also take care of the duties of the Nomination Committee. Two members of the Nomination and Compensation Committee are non-executive and independent. Alexander von Witzleben, member of the Nomination and Compensation Committee, was appointed delegate of the Board of Directors and interim CEO on 1 July 2015.

The Nomination and Compensation Committee is convened by the Chairperson of the committee as often as business requires, normally two to three times a year. The Nomination and Compensation Committee gives the Board of Directors recommendations regarding the Group's salary policy and compensation system. It submits a motion to the Board of Directors for the attention of the General Meeting regarding the total compensation for the members of the Board of Directors and the fixed and variable compensation of the members of Group Management. The Nomination and Compensation Committee determines the salaries of the individual members of Group Management. It approves, in principle, bonus programmes and profit-sharing schemes for employees as well as pension fund solutions and benefit plans. The Nomination and Compensation Committee is also responsible for the preparation of the Compensation Report and the request to the full Board of Directors for approval. Furthermore, the committee determines the principles for the selection of candidates for election to the Board of Directors and Group Management. It identifies suitable candidates for the Board of Directors and Group Management and conducts the requisite selection procedures. The Nomination and Compensation Committee also determines the principles for the management and development of the members of the Board of Directors and Group Management. It assists the Board of Directors in self-assessment and assesses the performance of the members of Group Management. In the reporting year, the Nomination and Compensation Committee dealt with, among other things, succession planning for the respective heads of the Doors, Windows and HVAC Divisions and submitted a corresponding proposal for each to the full Board of Directors. The Nomination and Compensation Committee then dealt with the concept of succession planning for key functions in the group in order to ensure business continuity.

Essentially, the Nomination and Compensation Committee fulfils a supporting and preparatory function for the benefit of the full Board of Directors. The Nomination and Compensation Committee is only authorised to make decisions regarding the tasks expressly delegated to it under the Group's regulation of powers. The full Board of Directors decides on matters not expressly delegated to the Nomination and Compensation Committee under the regulation of powers. The committee may submit issues within the scope of its decision-making powers to the Board of Directors.

The Nomination and Compensation Committee consists of the following members:

- Peter Barandun, Chairman

- Alexander von Witzleben

- Heinz Haller

The Nomination and Compensation Committee met five times during the reporting year. Of these, one meeting was held as a telephone conference and one meeting as a video conference. The interim CEO attended all five of the meetings, and the CFO attended two of the meetings. At the subsequent meeting of the full Board of Directors,, the Chairman reports on the meetings of the Nomination and Compensation Committee.

The meetings of the Nomination and Compensation Committee lasted one and a half hours on average.

3.4.3Working procedures of the Board of Directors

The Chairperson convenes the Board of Directors as often as business requires, but at least four times a year. During the reporting year, the Board of Directors met for five ordinary and two extraordinary meetings. Three of these meetings were held as a video conference and two meetings as a telephone conference. In the reporting year, the Board of Directors also passed four resolutions by circular letter. Ordinary meetings of the Board of Directors usually last half of a day. One of the five ordinary meetings in the reporting year lasted an entire day. Extraordinary meetings, of which there were two in the reporting year as mentioned, usually last one hour. In the reporting year, the Board of Directors performed its duties directly. The interim CEO and CFO attended all meetings. The members of Group Management attended the five ordinary meetings. Managers are regularly invited to meetings to discuss issues that fall within their field of responsibility or scope of activities.

The Board of Directors reviews its operability and discusses its performance on various occasions in executive sessions that usually take place at the end of every meeting.

3.5Regulation of powers

The Board of Directors is responsible for guiding, supervising and monitoring management. It represents the company externally and attends to all matters that are not transferred to another body within the company on the basis of legislation, Articles of Association or by-laws. The Board of Directors enacts the necessary rules, instructions and guidelines and establishes the organisational structure and risk policy. The main duties of the Board of Directors are:

- Guidance of the Group and issuing of necessary instructions

- Establishment of the Group's organisational structure;

- Appointment and dismissal of persons entrusted with management;

- Supervision of persons entrusted with company management, specifically with regard to following legislation, Articles of Association, rules and instructions;

- Structuring of the accounting system, financial control and financial planning;

- Preparation of the Annual Report and the Compensation Report, as well as preparation for the General Meeting and implementation of its resolutions;

- Preparation of compensation requests for the General Meeting;

- Determination of the capital structure of the company;

- Issue of bonds, participation certificates, convertible bonds and options as well as determination of the terms and conditions;

- Determination of the strategy of the company, the divisions and the subsidiaries;

- Decisions concerning investments, joint ventures, real estates and participations, where these are of particular importance to the company and exceed a certain level;

- Annual risk assessment for the company;

- Notification of the court in the event of over-indebtedness.

The division of powers between the Board of Directors and Group Management is set out in detail in the by-laws (www.arbonia.com/en/company/organisation) and in the regulation of powers. Unless otherwise stated in legislation, the Articles of Association or by-laws, the Board of Directors delegates management entirely to Group Management, led by the Chairperson of Group Management (CEO), pursuant to Art. 2.5 of the by-laws (www.arbonia.com/en/company/organisation).

3.6Information and control instruments vis-a-vis the management board

Through various channels, the Board of Directors is regularly updated on the activities of Group Management and the divisions. The management information system (MIS) provides the members of the Board of Directors with key information about the financial and income situation of the Group on a monthly basis. The interim CEO reports regularly to the Board of Directors during ordinary meetings of the Board of Directors and without delay in the event of extraordinary developments. The members of Group Management regularly attend ordinary meetings of the Board of Directors and report on business in their areas. As a rule, the members of the Board of Directors may request any additional information required to carry out their tasks.

The external auditors provide the Audit Committee with information on the main findings of the audit. Regular contact also takes place between the Chairperson of the Audit Committee, the CFO and the Head of Internal Audit (see 3.4.2.1). Where required, he too informs the other members of the Board of Directors regarding his findings.

The principal role of Internal Audit is to monitor processes and structures throughout the Group. Internal Audit has also been responsible for the risk management process since the middle of the reporting year. Internal Audit summarises the audits it is to carry out in an annual audit plan. This audit plan also incorporates the identified risks as part of the risk management process that is performed every year in each of the divisions and in Corporate Functions. Each audit plan is approved by the Audit Committee. The Audit Committee also assigns special audit mandates to Internal Audit as and when required. The respective audit findings are discussed with the Audit Committee and communicated to the Board of Directors in writing. During the reporting year, the Internal Audit provided the members of the Board of Directors with 12 audit reports. If material risks are identified, measures are defined to reduce them. Internal Audit adopts a systematic approach to monitoring risks and measures and carries out its work in accordance with the international standards governing internal auditors' professional duties. It regularly reports to the Audit Committee and Board of Directors on the scale of risks and any changes to the risk situation as well as the status of measures implemented. The Board of Directors received a total of four written reports on the implementation of measures during the reporting year. The external auditors also have access to all audit reports and the reports from the ongoing monitoring of risks and measures. Additionally, Internal Audit issued three Internal Audit status reports informing the Audit Committee and the Board of Directors about the key findings from the audits and the current status of the internal control system (ICS).

Furthermore, the Audit Committee and Board of Directors receive information concerning the results of the risk management process.

The Audit Committee is also informed about incoming whistleblowing reports. Three internal reporting offices are available for reports of this kind. All Arbonia employees are requested to report any violations of the Code of Conduct of which they become aware (www.arbonia.com/de/unternehmen/corporate-governance/#tab-code-of-conduct).

4Group Management

4.1Members of Group Management

In June 2020, Peter Spirig, the former Head of the Doors Division, and Harald Pichler, the former Head of the Windows Division, stepped down from their functions and as members of Group Management. On 1 July 2020, Claudius Moor took over as Head of the Doors Division and Nicolas Casanovas as Head of the Windows Division, which means that they have both been members of the Group Management since then. As of 31 December 2020, Group Management consisted of the following members:

Alexander von Witzleben

(see 3.1). Delegate of the Board of Directors and interim CEO since 1 July 2015.

Other activities and vested interests: (see 3.1)

At the Annual General Meeting on 22 April 2022, Alexander von Witzleben will step down from Group Management.

Daniel Wüest

1970, Swiss citizen, Master of Arts (lic. oec. publ.) in economics with specialisation in Finance and Banking, Chief Financial Officer (CFO) since 2019; 2014–2019 Head of Mid-Market Advisory Switzerland, UBS Switzerland AG, Zurich; 1997–2014 various positions at UBS Investment Bank Zurich: most recently from 2009–2014 as Managing Director Investment Banking.

Other activities and vested interests: Daniel Wüest has no other material activities or vested interests.

Ulrich Bornkessel

1956, German citizen, dipl. Business Administration, Emerging Leaders (MBA); Head of Heating, Ventilation and Air Conditioning Division since 2018; 2014–2017 Head of Air Conditioning & Ventilation Technology Business Unit; 2012–2013 Head of International Markets & Sales Arbonia Group (formerly AFG Group); 2011–2015 Chairman and CEO Ractec AG, Oberuzwil (SG); 2006–2009 CEO Airwell Air Conditioning Elco Holding, Tel Aviv (Israel); 2005–2006 European President Electro Consumer Products Elco Holding, Tel Aviv (Israel); 1993–2004 various positions at Carrier Corporation (United Technologies), Connecticut (USA); most recently, Director Germany, Nordic Countries & Eastern Europe (Carrier EMEA).

Other activities and vested interests: visiting lecturer at Lucerne University of Applied Sciences and Arts (HSLU) since 2010.

Ulrich Bornkessel will resign as of 30 June 2021 as the Head of the HVAC Division and as a member of Group Management due to his retirement. Alexander Kaiss will succeed him as of 1 July 2021 as the Head of the HVAC Division and member of Group Management.

Knut Bartsch

1968, German citizen, Dipl. Wirtsch. Ing., Head of the Sanitary Equipment Division and CFO of the Heating, Ventilation and Air Conditioning Division since 2018; Head of the Building Technology Division 2015–2017; 2004–2014 Divisional Spokesman of the Building Technology Division; 1996–1997 Assistant Corporate Manager at Preussag AG/TUI AG; joined Kermi GmbH in 1997, Director since 1999, Chairman of Kermi Group Management since 2015.

Other activities and vested interests: member of the CCI plenary meeting since 2013, deputy chairman of the CCI expert committee Industry of the Chamber of Commerce and Industry for Lower Bavaria since 2019.

Due to the integration of the Sanitary Equipment Division in the Doors Division effective 1 July 2021 (see section 1.1.1), Knut Bartsch will step down as the Head of the Sanitary Equipment Division and as a member of Group Management as of 1 July 2021.

Nicolas Casanovas

1984, Swiss citizen, Master in Marketing, Service and Communication Management, University of St. Gallen (HSG), Master in International Management, ESADE Barcelona (ES), Head of the Windows Division since 2020; 2018–2020 Managing Director Sales EgoKiefer AG and member of the Windows Division Management; 2017 Head of Group Strategy and Company Development of the Arbonia Group; 2011–2017 project manager in Zurich (CH), Munich (D), and Toronto (CA) at The Boston Consulting Group; 2010–2011 Assistant CFO Novartis Animal Health at Novartis AG.

Other activities and vested interests: Nicolas Casanovas has no other material activities or vested interests.

Upon closing of the sale of the windows business announced on 5 January 2021 and expected in the second quarter of 2021 (see section 1.1.1), Nicolas Casanovas will step down as a member of Group Management.

Claudius Moor

1983, Swiss citizen, Master in Information, Media and Technology Management, University of St. Gallen (HSG), Head of the Doors Division since 2020; 2019–2020 Managing Director Sales & Marketing Prüm and Garant, 2017–2020 member of the Doors Division management; 2015–2017 Head of Group Strategy and Company Development; 2010–2015 business consultant and project manager at The Boston Consulting Group; 2005–2010 founder and owner of Moor Business Support; 2002–2005 financial accounting clerk at General Dynamics European Land Systems – Mowag GmbH.

Other activities and vested interests: since 2019 advisory board and since 2020 chairman of the advisory board of KIWI.KI Berlin (D).

4.2Number of permissible mandates pursuant to Art. 12 para. 1 section 1 of the Swiss Ordinance Against Excessive Compensation (OaEC)

Members of Group Management may have a maximum of five mandates outside the Group, of which no more than one may be with a listed company. More details on the rules for the number of permitted mandates can be found in Art. 29 of the Articles of Association (www.arbonia.com/en/company/corporate-governance).

4.3Management contracts

Arbonia has not signed any management contracts with companies or natural persons outside the Group.

5Compensation, shareholdings, and loans

5.1Content and determination procedure for compensation and shareholding programmes

The basis and elements of compensation and the shareholding programmes as well as the procedure for their determination are presented in the Compensation Report on pages 107–114.

5.2Principles of performance-related compensation, the allocation of shares, and the determination of the additional amount

The variable compensation of members of Group Management depends on the company results. The success criteria comprise business-related targets. The full bonus amount determined in the individual agreement is paid out if the targets are fully achieved. If the targets are exceeded, the variable compensation may exceed the bonus amount determined by individual agreement up to a maximum amount. If achievement of the targets lies below a particular threshold, no variable compensation is paid. The variable compensation amounts to a maximum of 150% of the fixed compensation. In deviation from this regulation, the Board of Directors is exceptionally permitted in special situations to deviate from the time of target setting and target assessment, from the lower threshold, and from the maximum variable compensation. In these special situations, the Board of Directors sets the corporate objectives, which must be related to the special situation, at the time it chooses and determines the relevant time for measuring the objectives. It also determines the maximum additional variable compensation, which may in no case exceed twice the annual salary, consisting of fixed and maximum variable compensation. More details on performance-related compensation can be found in Art. 24 of the Articles of Association (www.arbonia.com/en/company/corporate-governance).

The Board of Directors determines the details of the assignment of shares to the members of the Board of Directors and Group Management in a share-based payment programme. Art. 25 of the Articles of Association contains information on what the share-based payment programme covers (www.arbonia.com/en/company/corporate-governance).

An additional amount is available for the compensation of members of Group Management who are newly appointed or promoted after approval of the maximum total compensation for Group Management if the compensation already approved for the period involved is insufficient. This additional amount may not exceed 40% for the CEO and 20% each for every other member of Group Management of the approved total compensation for Group Management for the period involved. This rule can be found in Art. 27 of the Articles of Association (www.arbonia.com/en/company/corporate-governance).

5.3Loans, credit, and pension benefits

According to Art. 26 of the Articles of Association, Arbonia shall not grant the members of the Board of Directors and Group Management any loans, credit, or pension benefits outside the occupational pension scheme or securities. Exempt from this are advances of social security and tax charges for persons subject to withholding tax (www.arbonia.com/en/company/corporate-governance).

5.4Rules concerning voting at the General Meeting on compensation

Pursuant to Art. 23 of the Articles of Association, for each compensation period the Board of Directors brings forward motions for the General Meeting concerning prospective approval of the maximum compensation of the Board of Directors for the period until the next ordinary General Meeting and of the maximum fixed and variable compensation of Group Management for the next financial year. Art. 23 of the Articles of Association grants the Board of Directors the right to waive prospective approval of compensation on motions and to have the General Meeting approve the total amount of the corresponding payment in arrears for the previous official or financial year (retrospective approval). In 2016 the Board of Directors resolved to have votes on compensation carried out retrospectively in future. Every year, the Board of Directors submits the Compensation Report for the financial year ended to the General Meeting for consultative (non-binding) approval. More details on compensation agreements can be found in Art. 23 of the Articles of Association (www.arbonia.com/en/company/corporate-governance).

6Shareholders’participation

6.1Voting right restriction and representation

The Articles of Association do not contain any regulations that deviate from the law with regard to participation in the General Meeting and exercise of voting rights. Each share registered in the share register entitles the holder to one vote. Every shareholder may be represented at the General Meeting by a proxy furnishing written power of attorney or by the independent proxy (with written or electronic power of attorney).

According to Art. 12 of the Articles of Association, the Board of Directors determines the requirements for the power of attorney, and instructions for the independent proxy. Under this regulation, the Board of Directors is also entitled to determine the requirements for electronic voting (www.arbonia.com/en/company/corporate-governance).

6.2Statutory quorums

Under Article 13 (9) of the Articles of Association, registered shares may only be converted into bearer shares by a resolution at the General Meeting, approved by at least two thirds of the voting shares represented and the absolute majority of the nominal share value represented. Under Article 12 (6) of the Articles of Association, in the event of votes which do not produce a result in the first round, the relative majority shall decide in the second round. Apart from this, the Articles of Association do not contain any regulations that deviate from the law (www.arbonia.com/en/company/corporate-governance).

6.3Convocation of the General Meeting

The Articles of Association do not contain any regulations that deviate from the law.

6.4Inclusion of items on the agenda

Shareholders who individually or together hold CHF 1 000 000 of nominal share capital are entitled to submit a written request for inclusion of an item on the agenda. Such requests must be submitted to the Board of Directors in writing, specifying the motions, at least 40 days before the date of the General Meeting.

6.5Entries in the share register

When sending invitations for the General Meeting, the Board of Directors will announce the date up to which entries can be made in the share register with regard to participation in the General Meeting.

7Change of control and defence measures

7.1Duty to make an offer

A purchaser of company shares must make a public offer as stipulated by Art. 135 (1) of the Federal Act on Financial Market Infrastructures and Market Conduct in Securities and Derivatives Trading (FinfraG). There is no opting-out clause (Art. 125 (3) and (4) of the FinfraG) or opting-up clause (Art. 135 (1) of the FinfraG).

7.2Change-of-control clauses

Arbonia has no agreements or plans for the benefit of members of the Board of Directors and/or Group Management or other members of senior management that contain change-of-control clauses. However, the share-based payment programme for members of Group Management and the Board of Directors allows the Board of Directors to cancel the vesting period for the transfer of the granted shares in the event of a change of control.

8Statutory auditors

8.1Duration of the mandate and term of office of the lead auditor

8.1.1Date of assumption of the existing mandate

On 28 April 2017, the General Meeting elected KPMG AG, St. Gallen, as the new statutory auditor. It audits the 2020 Financial Statements and the consolidated financial statement of Arbonia.

8.1.2Assumption of office of the lead auditor

Kurt Stocker has held the position of lead auditor since 28 April 2017.

8.2Auditing fees

In 2020, the various statutory auditors billed a total of CHF 1 191 000 (previous year: CHF 1 235 000) for auditing the Financial Statements and consolidated financial statement of Arbonia and the Financial Statements of the Group companies. Of this amount, the statutory auditor KPMG AG accounted for CHF 1 050 000 (previous year: CHF 1 047 000) in 2020.

8.3Additional fees

In 2020, the statutory auditor KPMG AG and other statutory auditors of Group companies billed CHF 1 750 000 (previous year: CHF 369 000) for additional services, CHF 1 743 000 (previous year: CHF 341 000) of which was attributable to KPMG AG. Of the additional services performed by KPMG AG in 2020, CHF 941 000 was for tax advice, CHF 740 000 for Due Diligence services and CHF 62 000 was for other services.

8.4Informational instruments of the external auditors

The external auditors attended a total of three meetings of the Audit Committee in the reporting year. The Audit Committee monitors the qualification, independence, and performance of the external statutory auditors on behalf of the Board of Directors and reports to the Board of Directors on its findings. In the reporting year, the Audit Committee oversaw the activities of the external statutory auditors by having the reports on the Financial Statements, consolidated financial statement and the comprehensive report explained directly by the statutory auditors (see section 3.4.2.1). The external auditors and Internal Audit also regularly discuss the methodology and further development of the internal control system (ICS). The internal and external auditors closely cooperate in the assessment of the substance of the ICS under Art. 728a of the Swiss Code of Obligations and the evaluation of the effectiveness and efficiency of the ICS. The following factors are considered in the choice of external auditors: professional expertise, international network (representation in the relevant countries), value for money, industry experience as well as continuity, and rapid availability of the audit team.

At the request of the external statutory auditor, the Audit Committee approves the audit fees and reviews them in light of developments in the previous year and an assessment of performance to ensure that they are appropriate. In accordance with the law, the external auditors' lead auditor is rotated at least once every seven years.

9Information policy

Arbonia pursues an open information policy towards the public and financial markets, based on the principles set out in the SIX Exchange Regulation listing rules and directives and in the Swiss Code of Best Practice for Corporate Governance. By means of the annual report, Arbonia provides information about business performance, organisation, and strategy. Integral parts of the Annual Report are the Management Report from page 3, the Compensation Report from page 107, and, for the first time, the Sustainability Report starting on page 48 for the reporting year 2020. Arbonia's First Semester Financial Report contains the consolidated income statement, statement of comprehensive income, balance sheet, cash flow statement, and statement of changes in equity. During the reporting year, Arbonia published twelve press releases. In addition to this, Arbonia gives comprehensive reports on its operating activities at its annual financial media and analyst conference. Arbonia also fosters dialogue with investors and the media at special events and roadshows.

Arbonia's contact details are as follows:

Arbonia AG

Amriswilerstrasse 50, 9320 Arbon, Switzerland

T +41 71 447 41 41, F +41 71 447 45 88

holding@arbonia.com

All company information is available on the website www.arbonia.com. Interested parties can subscribe to press releases at www.arbonia.com/en/media/subscribe-to-press-releases, and Arbonia publications can be ordered at www.arbonia.com/en/media/order-publications. All published press releases can be found at www.arbonia.com/en/media/press-releases.

The calendar of events is provided on page 223 of the Annual Report and on the Arbonia website at www.arbonia.com/en/investors.