Capital market review

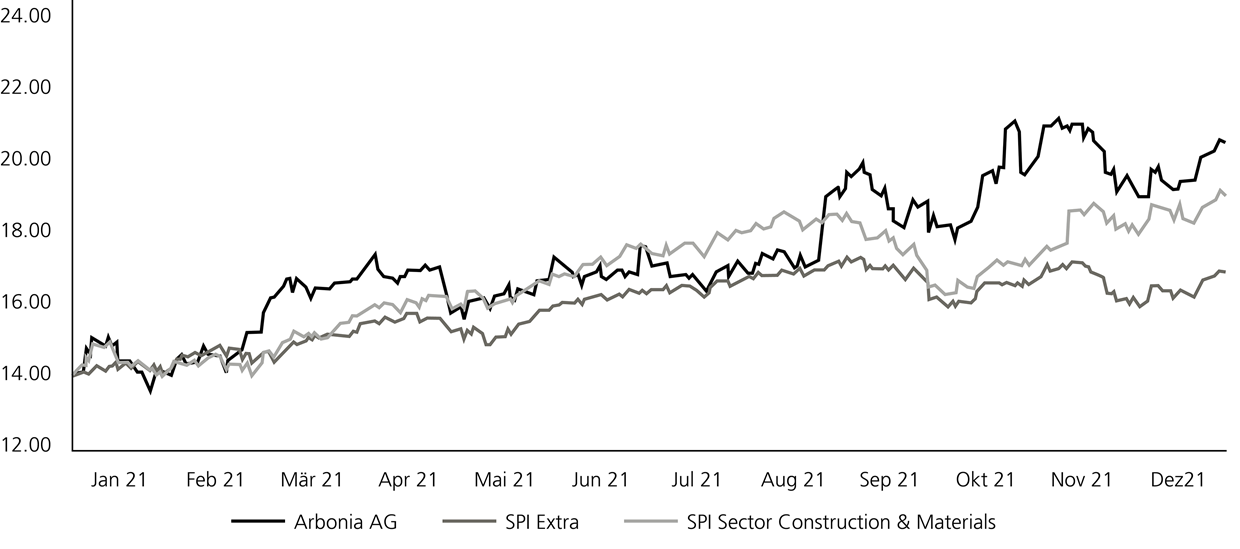

Due to the high number of Corona cases as well as the associated uncertainty, stock markets initially started off the year 2021 with a "wait-and-see" attitude and therefore only rose insignificantly in the first two months. Starting in March, however, share prices conti- nuously increased when many companies reported positive annual results, the economy steadily improved, and many pandemic containment measures were withdrawn. This development temporarily slowed down at the end of April / beginning of May, as a renewed increase in case numbers and supply bottlenecks led to a sharp increase in raw material prices. Case numbers then went down again, and the economy continued its robust recovery. In September, however, new fears caused the markets to consolidate: The default of the highly indebted Chinese real estate group Evergrande fuelled fears of a new financial crisis. These did not come true, but the appearance of the omicron variant, the announcement that the US Federal Reserve would end its low-interest policy, and continuing bottlenecks in the supply chain were sufficient to slow down the markets until the end of the year. However, the supposedly cyclical construction supply industry was able to grow further, and the sector index SPI Sector Construction & Materials was able to increase by 35.3% in 2021, while the SPI Extra "only" increased by 20.0%.

Arbonia shares initially started with a positive reaction to the sale of the Windows Division in 2021 and achieved their highest level (CHF 15.16) since August 2018 before they adjusted to the market sentiment and dropped under the mark of CHF 14.00 due to profit taking. Afterwards, the exceptionally positive results of the financial year 2020 boosted the shares, and they again achieved new heights and remained significantly above the benchmark indices until the end of April. After the distribution of the combined dividend for the financial years 2019 and 2020, however, some shareholders apparently used the high share price to realise profits. As a consequence, Arbonia shares rose less sharply than other companies in the building supply sector and then, shortly before the half-year results, hardly at all, due to the concern about high raw material prices and supply bottlenecks. Upon the announcement of the very good results, these concerns disappeared though, and the shares rose sharply again before they briefly consolidated, only to rise sharply again after the announcement of the new mid-term targets (until 2026) on the Capital Markets Day. In this phase, the shares reached its annual peak at CHF 21.25, which would have corresponded to an annual performance of 50.1%. At the end of the year, general economic uncertainties dominated events again, causing Arbonia shares to consolidate and only rise a little at the end of the year. They closed out the year 2021 at a price of CHF 20.60, which corresponds to a share price increase of 45.5% compared to the beginning of the year (CHF 14.16). On the whole, Arbonia shares thus achieved a considerable excess return compared to the benchmark indices.