Doors Division

Following the integration of the former Sanitary Equipment Division, the Doors Division now consists of two Business Units: Wood Solutions and Glass Solutions.

The Wood Solutions Business Unit, consisting of the companies Prüm, Garant, Invado, and RWD Schlatter, is one of Europe's leading providers of interior wooden doors and door frames. The business unit has four production sites: two in Germany, one in Switzerland, and one in Poland. In the domestic markets, the business unit offers its customers a comprehensive range of products from standard doors through to complex functional doors.

As a specialist for shower enclosures and shower area products, the Glass Solutions Business Unit offers conclusive solutions for all generations, lifestyles, and types of residences. Thanks to its strong brands Kermi, Koralle, and Baduscho, the business unit is the European market leader. In addition to the integrated production site in Germany and a locally oriented manufacturing site in Switzerland, the business unit also has distribution companies in Austria, Poland, the Czech Republic and Russia.

Market trends

The Doors Division achieved a revenue growth of 8.3% in the reporting year, from CHF 509.4 million in the previous year to CHF 551.8 million. When adjusted for currency and acquisition effects, the revenue increased by 6.9%. EBITDA without one-time effects grew from CHF 66.1 million in the previous year to CHF 76.3 million (+15.3%). With one-time effects, the division achieved a 15.2% higher EBITDA of CHF 76.2 million (previous year: CHF 66.1 million). EBIT without one-time effects amounted to CHF 43.3 million, compared to CHF 35.1 million in the previous year (+23.1%). With one-time effects, a 22.8% higher EBIT of CHF 43.2 million resulted in comparison to the previous year (previous year: CHF 35.1 million). All figures for the previous year refer to the former Doors Division including the former Sanitary Equipment Division.

The division's considerable revenue growth in the reporting year is primarily due to the very well performing German market, which continues to benefit from a strong construction industry that has a considerable pent-up demand from the last decades. However, a lack of material availability and a resulting shortage was felt especially in the second half of 2021, resulting in post- ponements and delays on construction sites. However, in the end, the enormous increases in material prices, combined with supply shortages, caused the start of even already approved construction projects to be postponed.

The assurance of material availability and the price increases were unprecedented and aggravating challenges. Due to a pandemic-related supplier shortfallo, wood-based materials flew off the shelves in the USA and China and were missing in terms of volume on the european markets. In addition, steel and aluminium prices also rose to an all-time high. It was therefore unavoidable to integrate material price increases into the sales prices. It was possible to maintain the supply chains with a great deal of dedication.

The German market shows a high pent-up demand for new residential construction. In recent years, new construction volume of around 260 000 to 280 000 flats has been realised, while the actual annual demand is up to 400 000 new flats. The reason for this is primarily the shortage of skilled workers in the German construction industry. The construction backlog amounts to roughly 700 000 flats, which corresponds to a new construction volume of more than two years.

The renovation market, on the other hand, remained very stable. The division, and especially the Wood Solutions Business Unit, is increasingly observing that doors installed after German reunification have now reached the end of their life cycle and need to be replaced.

The Wood Solutions Business Unit succeeded in further expanding its market share in residential construction in Germany. It is growing strongly in the area of institutional clients such as housing companies and is also seeing an increase in hotel and retirement home construction due to the attractive mix of quality and quantity. For the Glass Solutions Business Unit, the first half-year of 2021 was very positive, especially in comparison with the previous year: The sanitary industry was hardly affected by lockdown measures, while at the same time many consumers concentrated on their own housing situation since the beginning of the pandemic and many construction and renovation projects were realised with the usual lead time. In addition, trade and crafts increased their stocks for fear of supply shortages.

However, the market turned around in the summer and the momentum slowed down noticeably, while the base effect had an impact at the same time. Since the pent-up demand in the second half-year of 2020 was strong resulting from the pandemic-related weak first half-year of 2020, the picture in the second half-year of 2021 was much more moderate. Towards the end of the reporting year, construction delays caused by a lack of materials on many construction sites further slowed down the development.

The division was also able to improve its revenue level in the stagnating Swiss market. In Switzerland, the Wood Solutions Business Unit, with the company RWD Schlatter, is traditionally focussing heavily on the project business, where it was able to significantly increase its market share. The commercial business, in which the business unit has a much smaller market share, showed a slightly declining development in the reporting year.

The Wood Solutions Business Unit will be able to increase its market share in this segment again and for this purpose has built up an experienced team with a sales location in Jongny (CH) in the reporting year. This new approach to regional market development promises growth opportunities and strategically closer links to architects and finishing trade.

The Glass Solutions Business Unit benefited from continued stable demand for high-quality shower solutions in Switzerland. In all countries, the target groups of prefabricated house and wet cell manufacturers are gaining relevance due to the steadily increasing demand in the market and are to be focused on even more strongly in the future. The topic of service continues to play a central role. In order to meet the customers' requirements, the service business is continuously being successfully expanded.

The Polish company Invado had to deal with exceptionally difficult challenges. The extreme price increases and limited availability of materials on the Eastern European markets affected Invado disproportionately. Further temporary closures of customer branches due to the pandemic situation in almost all export markets led to a decline in regular demand. The negative effects from these particular challenges in 2021 were offset by cost-saving programmes and productivity increases aimed at expanding market shares in Poland, the Czech Republic and Slovakia in the coming years.

Products, technology, and innovation

One of the most important differentiating features of doors is the edge technology, since the edge is the most technologically demanding part in the door production process. In addition, the door edge is also the most exposed part of a door and is most affected by damage (impacts). The Wood Solutions Business Unit has therefore invested in a new premium door edge that offers new opportunities, especially in the project business in Germany.

A large part of the investments went into the capacity expansion of the two German production plants Prüm and Garant of the Wood Solutions Business Unit. The largest items were the purchase of the property at Garant and at Prüm the second high-bay warehouse, the combined heat and power plant (CHP) and the construction of the new frame plant. Arbonia also invested in a coating robot at RWD Schlatter and started the planning for a raw materials and finished goods warehouse.

The division also invested in IT and digitisation of processes, which is progressing at all locations. For example, the Doors Division is in the process of rolling out SAP S4/Hana in the Wood Solutions Business Unit. Harmonising the ERP system will make the cooperation between the four door companies much more efficient. The new "DoorIT – The Platform for Doors" will also be brought to market in early 2023. The platform allows for more efficient collaboration with specialist trade partners in the areas of configuration, quotation, and order processing. With the new tool, the division will have a clear differentiation potential compared to competitors.

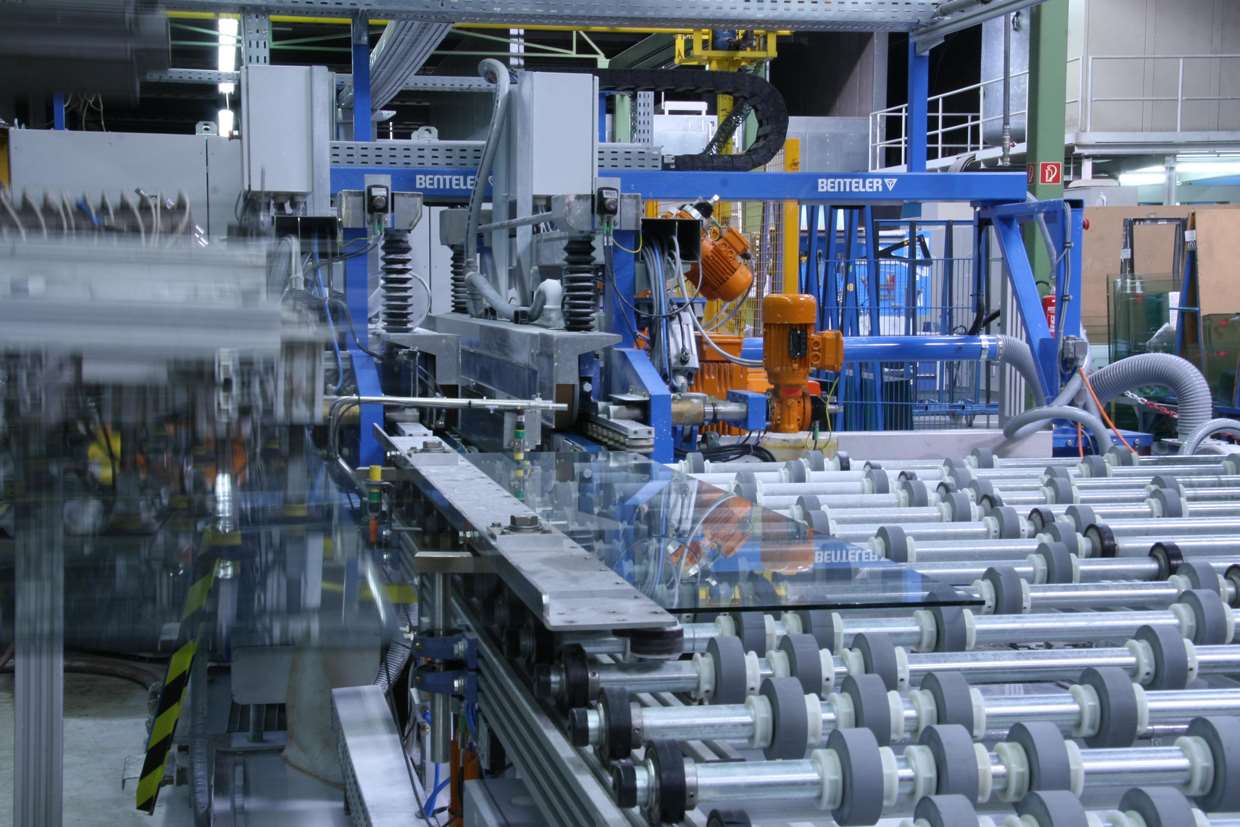

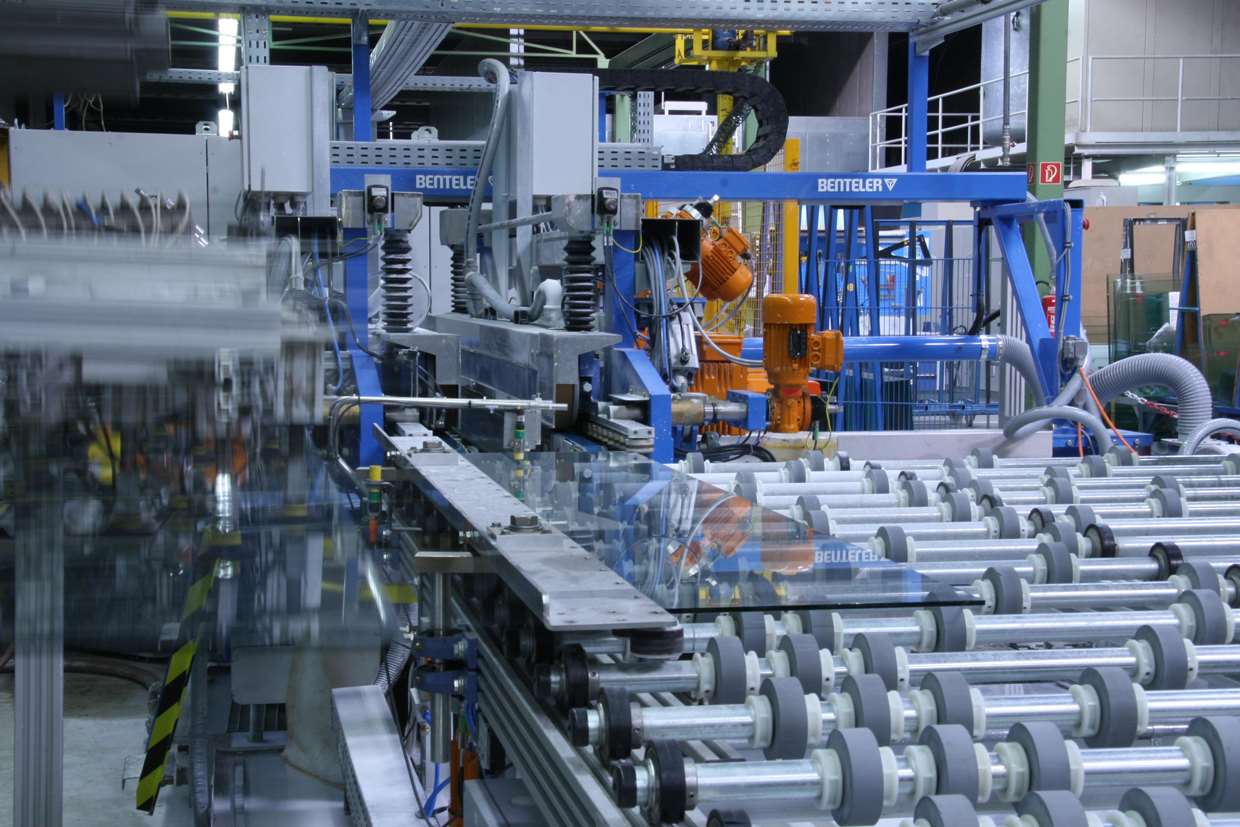

An important milestone in the reporting year was the acquisition of Glasverarbeitungs-Gesellschaft Deggendorf mbH (GVG). The Glass Solutions Business Unit is thus increasing its vertical integration by sourcing processed single-pane safety glass within the Group. The separation of GVG from the Saint-Gobain Group and its integration into the Glass Solutions Business Unit is proceeding according to plan, and the most important milestones were already successfully completed at the end of 2021. This sets the stage for future growth and further process improvement.

In the product range of Kermi shower designs, the "MENA" series was supplemented and "NICA" was expanded to include attractive versions without a wall profile. The Koralle range presented new products such as the new double series "Koralle SL750 / SL757". The Swiss company Bekon-Koralle of the Glass Solutions Business Unit presented the fourth mounting system of the "X88 Free" series. The "X88 Free GT" (Glue Tec, a seamless fastening technology) is only glued to the wall and floor and thus stands out not only in terms of technology and function, but also with exceptional aesthetics.

Outlook

Germany, the most important market for the division, is expected to continue to grow due to the housing shortage. The Swiss market is expected to stagnate at a very good level and, like the Eastern European markets, offers opportunities to further expand market shares. The prospects in 2022 could be somewhat weakened by the progress of material price increases, material shortages and the associated postponement or suspension of construction projects. The division expects the turbulent supply situation on the procurement markets and the pandemic-related restrictions to calm down in the course of 2022. Until then, supply chain and delivery reliability will remain challenging. The high and rising level of energy prices and the continuing shortage of skilled workers in many industries will continue to have a negative impact.

Appreciation for housing has increased during the COVID-19 pandemic. This applies to both the built quality and the living space. In addition, the construction industry is likely to benefit from stimulus programmes from public authorities. In particular, the new government coalition in Germany intends to continuously support residential construction.

The Doors Division will therefore continue to improve its processes and drive forward its high product quality and service orientation. Thus, the division sees itself in a good starting position to continue to grow profitably.