- Compensation Report

- 1. Governance

- 2. Principles of the compensation system

- 3. Compensation structure of the Board of Directors

- 4. Compensation structure of Group Management

- 5. Compensation of the Board of Directors for the year 2021 (audited)

- 6. Compensation of Group Management for the year 2021 (audited)

- 7. Loans and credit (audited)

- 8. Shareholdings as of 31 December 2021

Compensation Report

The Compensation Report sets out the compensation governance, the principles of the compensation system, as well as the structure of the compensation of the Board of Directors and Group Management of Arbonia AG (hereinafter "Arbonia"). This report also contains information on the compensation of the Board of Directors and Group Management in financial year 2021.

The information in the Compensation Report on the compensation of the Board of Directors and Group Management in financial year 2021 has been audited by the statutory auditor. The audit report is found on page 130.

The Compensation Report has been compiled in accordance with the Ordinance against Excessive Compensation in Listed Companies Limited by Shares (hereinafter "OaEC") and the guideline concerning Information on Corporate Governance (RLCG) of the SIX Exchange Regulation from 18 June 2021. The information refers to reporting year 2021, unless indicated otherwise.

1.Governance

1.1.Membership of the Nomination and Compensation Committee

According to the Articles of Association of Arbonia (www.arbonia.com/en/company/corporate-governance; hereinafter "Articles of Association") and the by-laws (www.arbonia.com/en/company/organisation), the Nomination and Compensation Committee consists of two or more members.

The members of the Nomination and Compensation Committee are elected by the General Meeting for one year of office each time. The Chairman of the Nomination and Compensation Committee is appointed by the Board of Directors at the request of the committee members.

At the constituent meeting on 23 April 2021, Peter Barandun was re-elected as the Chairman of the Nomination and Compensation Committee.

In the 2021 / 2022 year of office, the Nomination and Compensation Committee consisted of the following:

The Chairman as well as a further member of the Compensation Committee are independent and non-executive members of the Board of Directors. Alexander von Witzleben has been the delegate of the Board of Directors and interim CEO since 1 July 2015. He will resign as interim CEO on 22 April 2022 and also assume the office of the Executive Chairman of the Board of Directors, subject to his reelection as Chairman.

1.2.Responsibilities

The Nomination and Compensation Committee is responsible for the Group’s compensation policy, especially at the top corporate level. In addition, the committee assists the Board of Directors in identifying and selecting candidates for the Board of Directors and Group Management. The duties and powers of the Nomination and Compensation Committee are set out in the Articles of Association (www.arbonia.com/en/company/corporate-governance), in the by-laws (www.arbonia.com/en/company/organisation), as well as in the regulation of powers. The committee submits motions to the Board of Directors for decision and makes proposals and recommendations.

The responsibilities of the Nomination and Compensation Committee include, e. g.:

- Periodic review of the salary policy and the compensation system

- Yearly review of the compensation of the Board of Directors and Group Management

- Assessment of the performance of the members of Group Management

- Identification of candidates for the Board of Directors and Group Management

- Determination of the principles for managing and developing the members of the Board of Directors and Group Management

The responsibilities related to the most important compensation issues at the level of the General Meeting, Board of Directors, and Nomination and Compensation Committee are presented in the following table:

1.3.Meetings, information policy, and recusal regulations

The Nomination and Compensation Committee convenes as often as necessary but at least twice a year. In the reporting year, the members of the Nomination and Compensation Committee met four times. One of the four meetings lasted an entire day; the other three meetings lasted for one hour on average. The attendance rate for all four meetings was 100%.

In the reporting year, in addition to the annually recurring topics related to compensation, the Nomination and Compensation Committee primarily focused on 1) succession planning with respect to the former head of the Heating, Ventilation and Air Conditioning Division, who retired on 30 June 2021 due to his age, and the associated personnel changes at the division management level, 2) the integration of the former Sanitary Equipment Division into the Doors Division as of 1 July 2021 and the associated personnel changes at the division management level, and 3) the two benchmark studies on CEO and Group Management compensation that were commissioned externally (cf. section 2.2).

Members of the Board of Directors not on the committee are kept informed about current topics as well as any significant resolutions and measures by the Chairman of the Nomination and Compensation Committee at the subsequent meeting of all members of the Board of Directors following each committee meeting. The minutes of the meetings of the Nomination and Compensation Committee can be reviewed by the entire Board of Directors.

The CFO is normally invited to the meetings of the Nomination and Compensation Committee, for which he has an advisory function. The CFO attended two meetings in the reporting year. The Chairman of the Nomination and Compensation Committee can invite further managers to the meetings if necessary.

The Chairman of the Board of Directors, Alexander von Witzleben, recuses himself and leaves the meeting room when his own performance or compensation in his role as the delegate of the Board of Directors and interim CEO is discussed. The CFO as well as all other managers present also leave the meeting room when their performance or compensation is discussed.

1.4.Involvement of the shareholders

Arbonia strives to disclose its governance in compensation topics, the compensation principles, the compensation system, as well as the specific implementation in the respective reporting year in a transparent way in the Compensation Report. The Board of Directors submits the Compensation Report to the shareholders according to Article 23 para. 7 of the Articles of Association (www.arbonia.com/en/company/corporate-governance) for consultative (non-binding) approval every year at the Ordinary General Meeting.

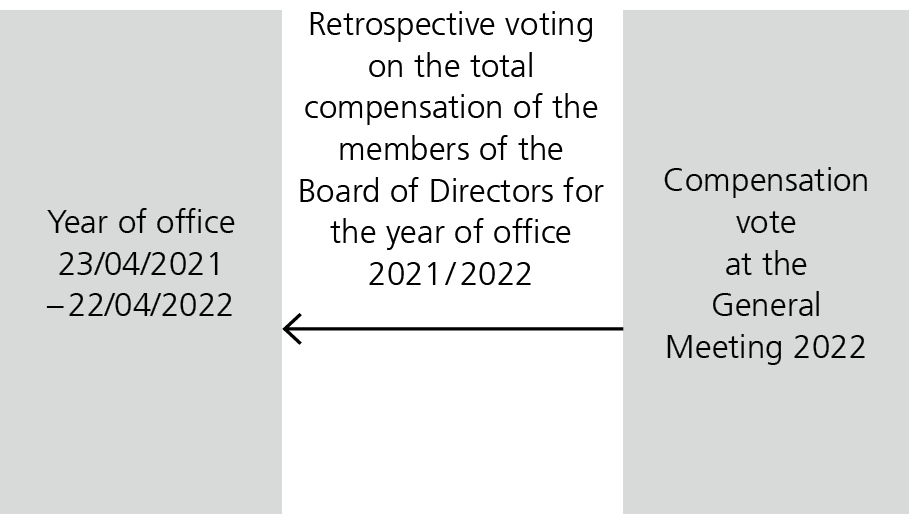

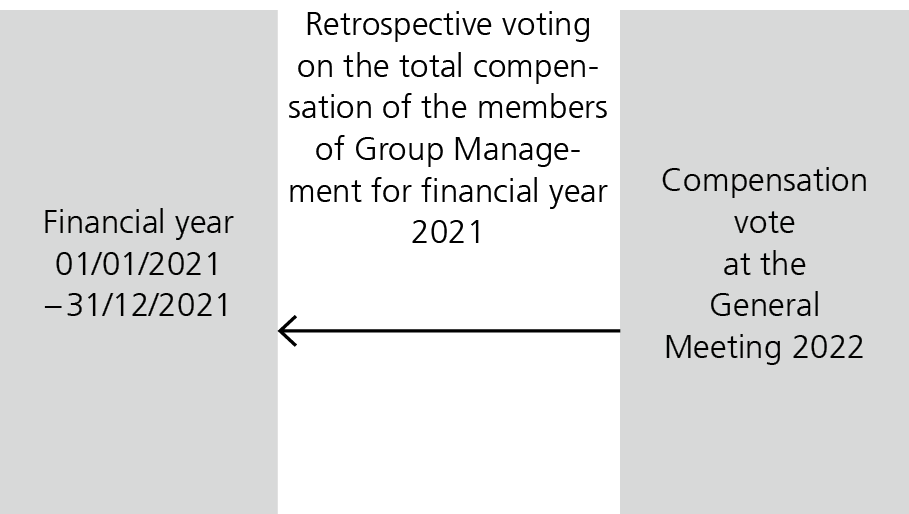

In addition to the Compensation Report, the Board of Directors submits the total compensation of the members of the Board of Directors and Group Management to the General Meeting for approval, as specified by the OaEC and in Article 23 of the Articles of Association (www.arbonia.com/en/company/corporate-governance). The two compensation votes are made retrospectively; in other words, the shareholders approve the total amount of compensation of the members of the Board of Directors for the year of office ending at the respective General Meeting on the one hand and the total amount of compensation of the members of Group Management for the financial year prior to the General Meeting in question on the other hand.

Voting on the total compensation of the members of the Board of Directors

Voting on the total compensation of the members of Group Management

In the past, the shareholders have always approved the two compensation votes as well as the above-mentioned Compensation Report, thereby expressing their positive opinion of the compensation policy practiced by Arbonia.

2.Principles of the compensation system

2.1.Principles and statutory anchoring

The compensation system and the structure of the occupational pension scheme (cf. section 4.6) are based on the conviction that the success of a company depends to a considerable extent on the quality and dedication of its personnel. Arbonia wants to leverage its compensation system and the total compensation paid on this basis to attract and retain people with the necessary skills and qualities and to motivate them to deliver a consistently high level of performance. The compensation system is designed to ensure that the interests of top managers are consistent with the interests of the Group and its shareholders.

In accordance with the regulations of the OaEC, the Articles of Association (www.arbonia.com/en/company/corporate-governance) contain the fundamental principles of the compensation system both in respect to the compensation of the Board of Directors as well as Group Management:

2.2.Benchmarking and external consultants

Arbonia audits the compensation of its managers, including the members of Group Management, on a regular basis.

At the end of 2020, Arbonia commissioned HCM International AG with two analyses. The one analysis concerned the compensation of the members of Group Management, except for the compensation of the CEO, and the other analysis concerned the compensation of the CEO. Both analyses were each performed based on a comparison group of industrial companies domiciled in Switzerland with a similar market capitalisation and a comparison group of industrial companies domiciled in Switzerland with a similar revenue. The comparison group with a similar market capitalisation included the following industrial companies: Interroll, Schweiter, Kardex, Bobst, Komax, Burckhardt, Implenia, Rieter, Phoenix, Burkhalter, Zehnder, Von Roll, and Feintool. The comparison group with a similar revenue included the following industrial companies: Stadler Rail, Bucher, Geberit, Dormakaba, OC Oerlikon, SFS Group, Bobst, Conzzeta, Schweiter, Daetwyler, Rieter, Phoenix, Zehnder, Belimo, and Feintool. Along with other publicly available data, these analyses served as the basis for determining the compensation, whereby the respective job holder's individual function, qualification for and experience in the function, as well as contribution to corporate success were additionally taken into account. Arbonia always strives to set compensation within the range of the market median. Except for these two mandates, HCM International did not receive any other mandate from Arbonia.

In 2018, Arbonia commissioned Korn Ferry to conduct a role evaluation for management and key Group functions using the HAY assessment system. Based on the job grades, the included functions were compared on a country-specific basis with comparable functions at international companies in the Hay databases. Except for this mandate, Korn Ferry did not receive any other mandate from Arbonia.

3.Compensation structure of the Board of Directors

3.1.Fixed compensation and lump-sum allowances

The members of the Board of Directors receive a fee in the form of fixed compensation for their work for the Board of Directors. The members of the Nomination and Compensation Committee and the Audit Committee receive an additional fee for their work for the committee, which is also paid out in the form of a fixed compensation.

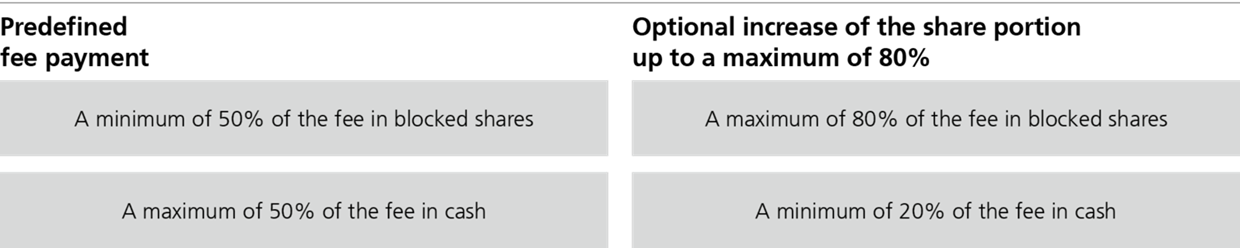

The fee – for the members of the Board of Directors as well as for the members of the committees – comprises a cash portion and a portion in the form of shares that are blocked for four years (hereinafter "blocked shares"). The share portion is at least 50% of the fee. Members of the Board of Directors and members of the committees who have their tax residence in Switzerland can receive the remaining 50% of the fee either entirely in cash or up to a maximum of a further 30% in shares and the rest in cash.

For members of the Board of Directors who have their tax residence outside of Switzerland – but within the European Union or the European Economic Area (EEA) – the share portion is also at least 50% of the fee. In regard to the remaining 50% of the fee, the percentage that can be paid out in shares instead of in cash is limited to a maximum of 15%. Thus, at most 65% of the fee can be paid in the form of shares and a maximum of 35% of the fee can be paid in cash.

Members of the Board of Directors who have their tax residence outside of Switzerland, the European Union, or the European Economic Area (EEA) are paid the entire fee in cash. For this reason, a member of the Board of Directors received the entire fee in cash in the reporting year.

The statutory contributions to the social insurance were paid from the cash portion of the fee.

Alexander von Witzleben waived a fee for his work as a member of the Nomination and Compensation Committee and the Audit Committee.

In addition to the fixed compensation (fee), the members of the Board of Directors receive lump-sum allowances. These allowances cover minor expenses and travel costs within Switzerland and are contained in the "other compensation" listed in the table in section 5.2. Costs of foreign travel and overnight stays are borne by the company.

In financial year 2021, the structure and amount of the compensation as well as lump-sum allowances for the Board of Directors were as follows:

1 NCC = Nomination and Compensation Committee

2 AC = Audit Committee

The members of the Board of Directors do not receive any attendance fees. No additional compensation is paid for preparing and attending the ordinary and extraordinary meetings of the Board of Directors, the Nomination and Compensation Committee, and the Audit Committee. No signing bonus or termination benefits are paid to the members of the Board of Directors.

The members of the Board of Directors – except for Alexander von Witzleben in his role as the delegate of the Board of Directors and interim CEO (cf. section 4.6) – are not insured in the pension scheme of Arbonia.

Arbonia will introduce the office of the Executive Chairman of the Board of Directors at the General Meeting on 22 April 2022. Assuming he is re-elected as Chairman, Alexander von Witzleben will additionally assume the office of Executive Chairman of the Board of Directors as of 22 April 2022. After 22 April 2022, nothing will change about the compensation for the office of Chairman of the Board of Directors. The compensation for the office of Executive Chairman of the Board of Directors will be based on the compensation structure valid for Group Management – consisting of a fixed and a variable compensation – and will be subject to the regulations applicable to Group Management as far as the variable compensation is concerned.

3.2.Variable compensation and in-kind benefits

The members of the Board of Directors, including the members of the Nomination and Compensation Committee and the Audit Committee, will neither receive a variable compensation nor in-kind benefits in the reporting year.

3.3.Board Member Share Plan

Making the Board of Directors partly take their fees in the form of restricted shares is designed to ensure that the incentive system is consistent with the long-term prosperity of the company, encourage a management philosophy which takes due account of risk, and reflect shareholder interests.

The Board of Directors determines the details of the allocation of shares to the members of the Board of Directors in a share-based payment programme according to Article 25 of the Articles of Association (www.arbonia.com/en/company/corporate-governance).

In accordance with the Board Member Share Plan approved by the Board of Directors, the fair market value will be ascertained in order to determine the number of shares. The calculation of the fair market value begins two trading days following the publication of the annual results achieved by Arbonia in the reporting year. The WVAP is calculated daily for 20 trading days based on the volume-weighted average share price. The fair market value results from the average of the WVAPs of these 20 trading days. The gross amount of the ordinary dividend is then subtracted from the fair market value if this is approved by the General Meeting, and a deduction of 20% is made for the four-year restriction period of the shares.

The shares are allocated after the record date for the dividend payment, at the latest 20 days after the General Meeting. The shares allocated in this way carry all associated rights. They are subject to a restriction period of four years, however, during which they cannot be disposed of.

If a member leaves the Board of Directors, the restriction period continues to apply, although the Board of Directors has the discretion to waive the restriction period. If a member leaves the Board of Directors due to invalidity or death, the restriction period automatically lapses.

In the case of a change of control, it is at the discretion of the Board of Directors to decide whether the restriction period will continue to apply or be lifted.

There is no option programme for the members of the Board of Directors.

4.Compensation structure of Group Management

4.1.Overview

The compensation of the members of Group Management consists of the following components:

- Fixed compensation

- Variable compensation according to Article 24 para. 1 of the Articles of Association (www.arbonia.com/en/company/corporate-governance), which is based on the nominal bonus determined by individual agreement

- If applicable, compensation according to Article 23 and Article 24 para. 2 of the Articles of Association (www.arbonia.com/en/company/corporate-governance), which is paid out in special situations

Since he assumed office, Alexander von Witzleben has waived a variable compensation in his role as the delegate of the Board of Directors and interim CEO.

The compensation structure of Group Management is therefore as follows:

4.2.Fixed compensation

The delegate of the Board of Directors and interim CEO, Alexander von Witzleben, and the other members of Group Management receive a fixed compensation.

The fixed compensation of Alexander von Witzleben in his role as the delegate of the Board of Directors and interim CEO consists of a cash portion and a portion of shares blocked for four years.

In the reporting year, Alexander von Witzleben received a fixed compensation to the amount of CHF 280 000 and 60 000 shares blocked for four years in his role as the delegate of the Board of Directors and interim CEO.

The fixed compensation of the other members of Group Management is exclusively paid in cash.

The fixed compensation of the members of Group Management is therefore as follows:

4.3.Variable compensation

The delegate of the Board of Directors and interim CEO, Alexander von Witzleben, does not have any nominal bonus determined by individual agreement. Since he assumed office in this function on 1 July 2015, he has waived the payment of a variable compensation.

The other members of Group Management receive a variable compensation based on the nominal bonus determined by individual agreement. This consists of 50% in cash and 50% in shares blocked for four years.

The variable compensation of the members of Group Management in the reporting year is therefore as follows:

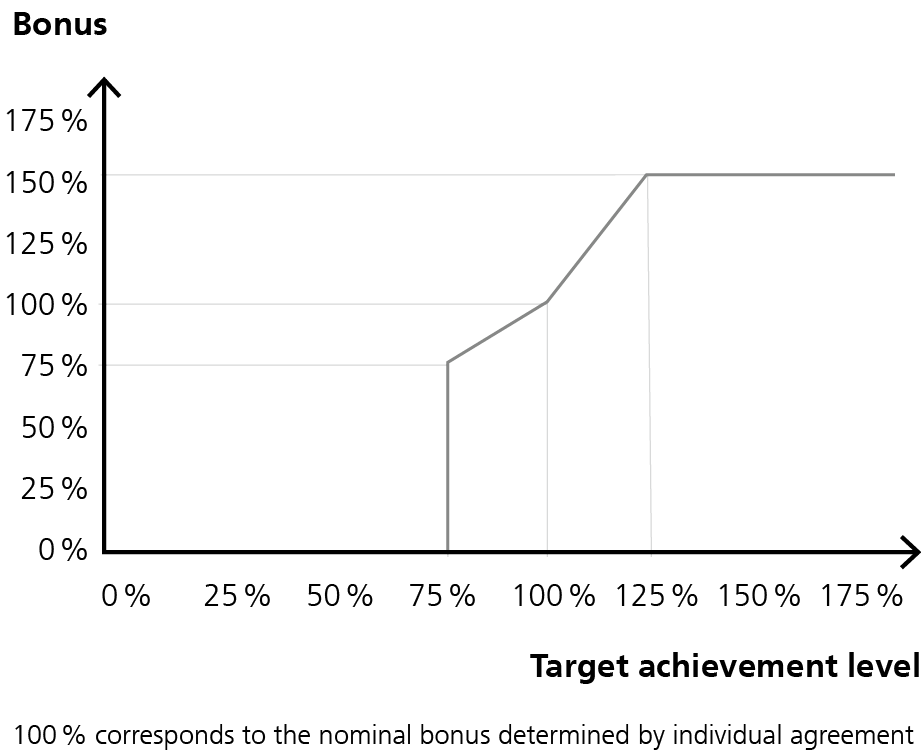

The nominal bonus determined by individual agreement that is paid in the case of a 100% target achievement is at most 70% of the fixed compensation.

The amount of the variable compensation depends on the achievement of financial targets.

In the reporting year, the financial targets are based on the following key performance indicators (KPI):

A certain percentage of the nominal bonus (100%) is allocated to each financial target. The weighting of the individual financial targets as a percentage of the nominal bonus varies.

At the request of the Nomination and Compensation Committee, the Board of Directors determines an expected target value for each financial target at the beginning of the financial year. This value is based on the budget approved by the Board of Directors for the respective financial year.

After the end of the financial year or after the audited annual results are available, the financial targets are rated according to their effective degree of achievement. In the case of a 100% achievement of all targets, a member of Group Management receives the nominal bonus determined by individual agreement. In the best case, 125% of the expected target value of a financial target can be achieved. In the case of a 125% target achievement, 150% of the nominal bonus is paid out pro rata for the corresponding target value – in accordance with its percentage share of the nominal bonus and its weighting. As a general rule, if at least 75% of a financial target is not met, the degree of achievement of the corresponding financial target is assessed at 0%.

The highest variable compensation achieved in the reporting year is in a ratio of 75.4% to the fixed compensation of the corresponding member of Group Management. This comparison does not take into account the compensation listed in section 4.4, which is paid out in special situations based on Article 23 and Article 24 para. 2 of the Articles of Association (www.arbonia.com/en/company/corporate-governance).

4.4.Special compensation

According to Article 23 and Article 24 para. 2 of the Articles of Association (www.arbonia.com/en/company/corporate-governance), the Board of Directors is authorised in special situations to award additional compensation to a member of Group Management that can be paid in cash and/or in the form of shares blocked for four years. In the reporting year, compensation was paid out four times to members of Group Management on this basis.

In and for the reporting year, Alexander von Witzleben received a one-off compensation in the form of 140 000 shares blocked for four years in his role as the delegate of the Board of Directors and interim CEO. Like all compensation subject to the OaEC, this compensation is subject to approval by the General Meeting. The Board of Directors has awarded this compensation to Alexander von Witzleben for the successful realignment of the Arbonia Group that he launched in 2015, the full achievement of the targets set in this context, and to compensate him for the extraordinary additional work he performed during this period, which went far beyond what would normally be expected.

In this connection, it is noted that the Board of Directors set Alexander von Witzleben's annual compensation for his role as the delegate of the Board of Directors and interim CEO to CHF 120 000 in cash and 60 000 shares blocked for four years upon his assumption of office on 1 July 2015. The share price hovered around CHF 13 when he assumed office and repeatedly in the following years as well. As of 1 January 2017, the Board of Directors increased the cash portion of Alexander von Witzleben's annual compensation from CHF 120 000 to CHF 280 000. This has been the only increase in Alexander von Witzleben's compensation since he assumed office on 1 July 2015. The above-mentioned one-off compensation to the amount of 140 000 shares blocked for four years should also be understood against this background, especially considering the great challenges with which Arbonia was confronted in 2015.

Special compensation was then paid out another three times in the reporting year.

The first compensation is in connection with the integration of the former Sanitary Equipment Division into the Doors Division, which was completed on 1 July 2021, and the related, expanded area of responsibility of the respective member of Group Management.

The second compensation is in connection with the introduction and hand-over work of the change in management of the Heating, Ventilation and Air-Con- ditioning Division completed on 1 July 2021 on the one hand and with the integration of the companies in Spain and Serbia that were acquired in the reporting year on the other hand.

The third compensation is in connection with a project in which the respective member of Group Management assumed responsibilities that are not part of his area of responsibility and involved extra work that went far beyond what would normally be expected.

4.5.Lump-sum allowances, in-kind benefits, and discounts

Alexander von Witzleben receives lump-sum allowances to the amount of CHF 6 600 annually in his role as the delegate of the Board of Directors and interim CEO. Several other members of Group Management receive lump-sum allowances to the amount of CHF 21 600 annually.

The members of Group Management are provided with a company car and a mobile phone. The private use of the company car is offset for members of Group Management according to the respective tax regulations applicable in the country.

Like all other employees, the members of Group Management can take advantage of various employee benefits, e. g., REKA cheques up to CHF 600 with a discount of 20% (only members with Swiss employment contracts) or discounts on Arbonia products.

4.6.Pensions provision

Group Management members with Swiss employment contracts are insured according to the occupational pension scheme regulations and according to the senior management pension scheme of Arbonia. The Arbonia senior management pension scheme covers the fixed salary not covered under the basic scheme and 80% of the contractual nominal bonus against old age, death, and incapacity risks. According to the Swiss Occupational Pensions Act (OPA), the maximum salary including bonus to be considered is limited to CHF 860 400 (as of 1 January 2021, corresponds to ten times the upper limit amount specified by the OPA), and the insured salary including bonus element is limited to CHF 648 320 (as of 1 January 2021). The employer contribution is the same for all three available plans and amounts to 25% of the insured salary (according to the regulations, in force since 1 January 2019). Alexander von Witzleben is insured in the Arbonia senior management pension scheme in his role as the delegate of the Board of Directors and interim CEO. The member of Group Management with a German employment contract has a pension solution with a German insurance company.

4.7.Arbonia Group Share Plan

The Board of Directors determines the details for allocating shares to the members of Group Management in a share-based payment programme according to Article 25 of the Articles of Association (www.arbonia.com/en/company/corporate-governance).

In accordance with the Arbonia Group Share Plan approved by the Board of Directors, the fair market value of shares is ascertained in order to determine the number of shares. The calculation of the fair market value begins two trading days following the publication of the annual results achieved by Arbonia in the reporting year. The VWAP is calculated daily for 20 trading days based on the volume-weighted average share price. The fair market value results from the average of the VWAPs of these 20 trading days. The gross amount of the ordinary dividend is then subtracted from the fair market value if this is approved by the General Meeting, and a deduction of 20% is made for the four-year restriction period of the shares.

The shares are allocated after the record date for the dividend payment, at the latest 20 days after the General Meeting. The shares allocated in this way carry all associated rights. They are subject to a restriction period of four years, however, during which they cannot be disposed of.

If an employment relationship is terminated, the restriction period continues to apply, although the Board of Directors has the discretion to waive the restriction period if necessary. If the employment relationship ends due to the attainment of retirement age, the restriction period automatically lapses. The restriction period also automatically lapses in the event that the employment relationship is terminated due to invalidity or death.

In the case of a change of control, it is at the discretion of the Board of Directors to decide whether the restriction period will continue to apply or be lifted.

There is no option programme for the members of Group Management.

4.8.Terms and conditions of employment

The employment contracts of the members of Group Management have been concluded for an unlimited term and with a notice period of six months. All employment contracts contain a recovery clause that requires members of Group Management to repay compensation that has been paid to them in full or in part but has not been approved by the General Meeting. No member of Group Management is entitled to a signing bonus, termination benefit, or compensation due to a change of control ("golden parachute").

5.Compensation of the Board of Directors for the year 2021 (audited)

5.1.Changes in the Board of Directors

Compared to the previous year, there were no changes to the Board of Directors, which continues to consist of eight members. Alexander von Witzleben is Chairman and Peter Barandun is Vice Chairman of the Board of Directors. Alexander von Witzleben has been the delegate of the Board of Directors and interim CEO since 1 July 2015.

Compared to financial year 2020, the total compensation of the Board of Directors remained unchanged in the reporting year.

5.2.Table

1 Employer contributions to social insurance policies

2 Lump-sum allowances

3 The compensation to Alexander von Witzleben in 2021 as Chairman of the Board of Directors is included in this table. The compensation as interim CEO totalling CHF 3 573 468 is included in the compensation of Group Management in chapter 6.2.

4 AC = Audit Committee

5 NCC = Nomination and Compensation Committee

6 The compensation to Peter Barandun for the term of office 2021/2022 is paid to Peter Barandun AG, which is responsible for the deduction and payment of social contributions.

7 The compensation to Peter E. Bodmer for the term of office 2021/2022 is paid to Beka-Küsnacht AG, which is responsible for the deduction and payment of social contributions.

1 Employer contributions to social insurance policies

2 Lump-sum allowances

3 The compensation to Alexander von Witzleben in 2020 as Chairman of the Board of Directors is included in this table. The compensation as interim CEO totalling CHF 1 167 760 is included in the compensation of Group Management in chapter 6.2.

4 AC = Audit Committee

5 NCC = Nomination and Compensation Committee

6 The compensation to Peter Barandun for the term of office 2020/2021 is paid to Peter Barandun AG, which is responsible for the deduction and payment of social contributions.

7 The compensation to Peter E. Bodmer for the term of office 2020/2021 is paid to Beka-Küsnacht AG, which is responsible for the deduction and payment of social contributions.

Compensation to former members of the Board of Directors

No compensation was paid to former members of the Board of Directors in 2021 or 2020.

Compensation to parties related to members of the Board of Directors

No compensation was paid to parties related to current or former members of the Board of Directors in 2021 or 2020.

6.Compensation of Group Management for the year 2021 (audited)

6.1.Changes in Group Management

Alexander von Witzleben has been Chairman of Group Management in his role as the delegate of the Board of Directors and interim CEO since 1 July 2015.

In the reporting year, Knut Barsch, Head of the former Sanitary Equipment Division, which was integrated in the Doors Division as of 1 July 2021, and Ulrich Bornkessel, former Head of the Heating, Ventilation and Air Conditioning Division, left Group Management as of 30 June 2021.

Nicolas Casanovas, Head of the Windows Division at the time, left Group Management as of 31 August 2021, i.e., upon completion of the sale (closing) of the windows business.

Alexander Kaiss, the new Head of the Heating, Ventilation and Air Conditioning (HVAC) Division, has been a member of Group Management since 1 July 2021.

The total compensation of Group Management has increased compared to the previous year. The increase is due to the compensation disclosed under section 4.4.

6.2.Table

1 The compensation of Alexander Kaiss and Knut Bartsch are paid in euros. The exchange rate used is 1.08 for 2021 and 1.07 for 2020.

2 Includes special compensations (cf. section 4.4)

3 Employer contributions to social insurances, occupational pension schemes, accident and health insurance

4 Comprises lump-sum allowances, private use of the company car/car allowance, and other services and in-kind benefits.

5 Includes the previous heads of the Sanitary Equipment and the Windows Division up to 30 June 2021 and the new head of the Windows Division up to 31 August 2021, includes previous head of the HVAC Division up to 30 June 2021 and the new head of the HVAC Division from 1 July 2021.

6 Includes the previous head of the Doors Division up to 31 August 2020 and the new head of the Doors Division from 1 July 2020, includes the previous head of the Windows Division up to 31 December 2020 and the new head of the Windows Division from 1 July 2020.

Compensation to former members of Group Management

No compensation was paid to former members of Group Management in 2021 or 2020.

Compensation of parties related to members of Group Management

No compensation was paid to parties related to current or former members of Group Management in 2021 or 2020.

7.Loans and credit (audited)

According to Article 26 of the Articles of Association (www.arbonia.com/en/company/corporate-governance), no loans, credits, or pension benefits outside the occupational pension scheme or collateral will be granted to the members of the Board of Directors and Group Management. Exempt from this are advances of social security and tax charges for persons subject to withholding tax. Alexander von Witzleben exercised this exemption in the reporting year in his role as Chairman and delegate of the Board of Directors and interim CEO, whereby no advance payments were outstanding as of 31 December 2021.

As of 31 December 2020 and as of 31 December 2021, there were no loans or credits to current or former members of the Board of Directors or Group Management or to parties related to current or former members of the Board of Directors or Group Management.

8.Shareholdings as of 31 December 2021

The current members of the Board of Directors and Group Management (including parties related to them) held the following number of shares as of 31 December 2021: