Capital market review

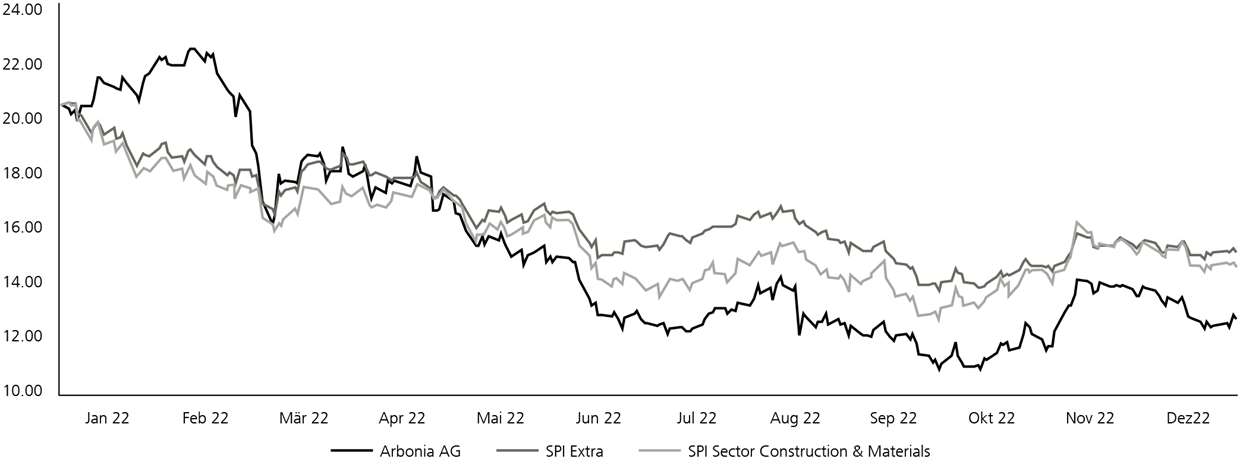

At the beginning of the reporting year 2022, the financial markets were dominated by discussions about an initial interest rate hike that was soon to occur at the time. This was intended to end the phase of cheap money on the one hand and to control rising inflation on the other. In January and February, many investors therefore shifted their capital from growth to value stocks, which initially caused the decline of highly valued technology stocks and then of the stock markets in general. After a brief recovery, however, it became apparent that the longer the war in Ukraine lasted, which had broken out at the end of February, the stronger the effects on the economy and society would become. As a result, share prices continued to fall until July 2022, when another short recovery phase occurred. However, this brief rebound was only based on the hope that markets had already reached their low point. From the middle of August 2022, prices then declined further when it also became clear that the high inflation rates would remain. Prices then fell to new lows by the end of September. At the lowest point, the SPI Extra recorded a price decline of 32.4% since the beginning of the year and the SMI was also 21.8% below prices at the beginning of the year. In the last quarter, however, prices were able to recover somewhat. Negative economic reports led to hopes that inflation had already reached its peak. The SPI Extra closed the year 2022 down 25.8%, the sector index SPI Construction & Materials fell by 27.0%, while the SMI with its defensive index heavyweights closed 16.7% lower.

The Arbonia share initially recorded a positive start to the year 2022 and reached a new high point (CHF 22.60 / + 9.7%) shortly before the publication of the 2021 annual results in February 2022. Due the war in Ukraine, however, the results of the 2021 financial year were not able to provide any positive stimulus, and the share price fell along with the market instead. In the following weeks, the political and economic news affected both the price of the Arbonia share and the stock markets in general. From early summer, the high inflation and rising interest rates then increasingly impacted the stock markets after fears had grown that these developments as well as increased construction costs would lead to a decline in construction activity. As a result, both the Arbonia share and the SPI Sector Construction & Materials index decoupled from the general market trend and underperformed the market as a whole. The publication of the First Semester Report at the end of August did not affect this development either. After the publication, the Arbonia share continued to move in line with the benchmark indices. Arbonia ultimately ended the year at a price of CHF 12.92, which corresponded to a decrease of 37.3%. In comparison, the SPI Extra fell by 25.8% and the sector index SPI Sector Construction & Materials fell by 27.0% in 2022. The shares of comparable companies such as Geberit (– 41.6%), Forbo (– 41.8%), and Zehnder (– 40.1%) once again performed very similarly to the Arbonia share.