Doors Division

The Doors Division consists of the Wood Solutions and Glass Solutions Business Units since the integration of the previous Sanitary Equipment Division in 2021.

The Wood Solutions Business Unit, comprising the companies Prüm, Garant, Invado, RWD Schlatter and Joro, is one of Europe’s leading providers of interior wooden doors and frames. The business unit has five production sites: three in Germany and one each in Switzerland and Poland. In the domestic markets, it offers its customers a comprehensive range of products from standard doors to complex functional doors.

As a specialist for shower enclosures and glass systems, the Glass Solutions Business Unit offers convincing solutions for all generations, lifestyles and types of residences. Thanks to its strong brands Kermi, Koralle, and Baduscho, it is the market leader in Europe. In addition to the two integrated production sites in Germany and the locally oriented manufacturing in Switzerland, it operates internationally through distribution companies.

Market trends

In the reporting year, the Doors Division achieved a revenue growth of 0.2%, from CHF 551.8 million in the previous year to CHF 552.7 million. Adjusted for currency and acquisition effects, revenue increased by 3.8%. EBITDA without one-time effects decreased from CHF 76.3 million in the previous year to CHF 62.2 million (–18.5%). The EBITDA margin was 11.3%. With one-time effects, the division achieved a 22.3% lower EBITDA of CHF 59.2 million (previous year: CHF 76.2 million). EBIT without one-time effects amounted to CHF 27.2 million, compared to CHF 43.3 million in the previous year (– 37.0%). With one-time effects, a 44.4% lower EBIT of CHF 24.0 million resulted compared to the previous year (previous year: CHF 43.2 million).

The high inflation throughout Europe resulted in a great price uncertainty for construction costs, causing especially private investors but also institutional investors to postpone or even temporarily halt construction projects. This was especially noticeable in the construction of new single-family homes during the reporting year. The Eastern European market of Poland was the most strongly affected by inflation, followed by Germany and then Switzerland in third place. The Swiss market was the least affected by inflation, which is also due to the strong devaluation of the euro against the Swiss franc.

The specialist and DIY store business of the Doors Division suffered due to various factors in the reporting year and experienced a decline in volumes. During and after the COVID-19 pandemic, many customers of the Doors Division had built up high inventories to prevent supply bottlenecks. In the reporting year, trade inventories were then reduced to a greater extent than in past years. A further issue was that the retail business is primarily oriented towards single-family homes, the construction of which, as mentioned, was increasingly postponed or halted. This decrease was less pronounced in the project business, especially in the segment of high-priced construction projects as well as in social housing. This led to a shift from standard doors to functional doors, which was partially able to offset the decline with room doors.

The project business was additionally strengthened by hotel construction. The division used this positive momentum to expand revenues in this segment. It entered further partnerships with hotel chains and housing co-operatives in the reporting year. The acquisition of the German company joro türen GmbH in the reporting year, which specialises in manufacturing special doors for protection against fire, smoke, noise and intruders in large-scale projects, also strengthens the project competence in Germany. In addition, the newly acquired company with its premium portfolio also supplements the product range of RWD Schlatter in Switzerland.

The material availability in Germany and Switzerland improved in the reporting year compared with the previous year, but some material groups still have supply bottlenecks. The high material prices also had to be offset by further price increases. However, these could only be passed on with a delay due to the record high order volume.

The Polish door manufacturer Invado was confronted with an even more difficult environment and higher inflation due to its geographic proximity to the war zone in Ukraine. This market suffered from the material price increases and limited material availabilities even more than the German and Swiss market. The difficult market situation and the SAP conversion, which tied up a lot of personnel resources, resulted in a double burden for the company. Thanks to the successful system conversion in September 2022 and the acquisition of new customers, Invado was able to at least stabilise the results in the fourth quarter.

The market for sanitary products suffered a sharp decrease in the reporting year. On the one hand, this is due to the fact that new construction projects were postponed or halted. Many renovation projects were either implemented during the Corona period, or builders are currently still waiting due to the price increases. On the other hand, installers continue to focus on the more lucrative installation of subsidised HVAC products. The Glass Solutions Business Unit also suffered more from the high energy prices than the Wood Solutions Business Unit. This is because the production of raw glass is very energy-intensive, which therefore made glass products even more expensive. The negative effects were offset by cost savings programmes as well as productivity increases. Market prices were increased in the Glass Solutions Business Unit as well to offset increasing material and energy costs. In Germany, the integration of the remaining Koralle distribution activities in Kermi was also initiated. This will make it possible to harness synergies and save costs.

The acquisition of Arbonia Glassysteme (formerly GVG) in 2021 and the related increase in vertical integration proved to be strategically correct in the reporting year, as sourcing glass within the group prevented even higher price increases at Kermi and Bekon-Koralle. In addition, the company was able to acquire further third-party customers, which contributed to a higher capacity utilisation.

Products, technology and innovations

One of the most important differentiating features of doors is the edging technology, since the edge is the most technologically demanding part of door manufacturing. Furthermore, the door edge is also the most exposed part and is affected the most by damage (impacts). In the reporting year, RWD Schlatter put a new cast edging system into operation, which gives door profiles an edge coating made of polyurethane (plastics or synthetic resins). This technology ensures a particularly rugged edge structure in the case of higher requirements. It is therefore used in particular with functional doors in heavily frequented buildings where components are subjected to especially high stresses. This is the case, for example, in hospitals, hotels, retirement and nursing homes, as well as schools.

In the reporting year, the Doors Division recorded an investment volume of around CHF 99 million. A large part of this went into further expanding the capacity of the two German production plants Prüm and Garant of the Wood Solutions Business Unit, whereby the largest portion of this was spent on the new frame plant as well as on the new combined heat and power plant (CHP) of Prüm. The frame plant was put into operation in the second half of 2022 and is currently being ramped up. Construction of the new CHP plant started in the first half of 2022 as planned. Starting in autumn 2023, the plant will be able to cover the complete heat generation as well as up to 60% of the power requirements of the site. In the first quarter of 2022, the ground-breaking ceremony was also held for the new logistics centre of RWD Schlatter in Switzerland. After the building is put into operation in the second quarter of 2023, it will be possible to provide the specialist trade in Switzerland with a larger product range in considerably shorter delivery times.

In the reporting year, the division also continued to invest in the digitisation of processes, which is progressing at all sites. For example, the Doors Division is in the process of rolling out SAP S4 / Hana at the Wood Solutions Business Unit. The harmonisation of the ERP system will allow the four door companies to cooperate more efficiently. The first step was the changeover at the Polish company Invado, which was successfully implemented in September 2022 after an intensive project phase. At the same time, the kick-off and the initial workshops for introducing SAP S4 / Hana took place at Prüm and Garant.

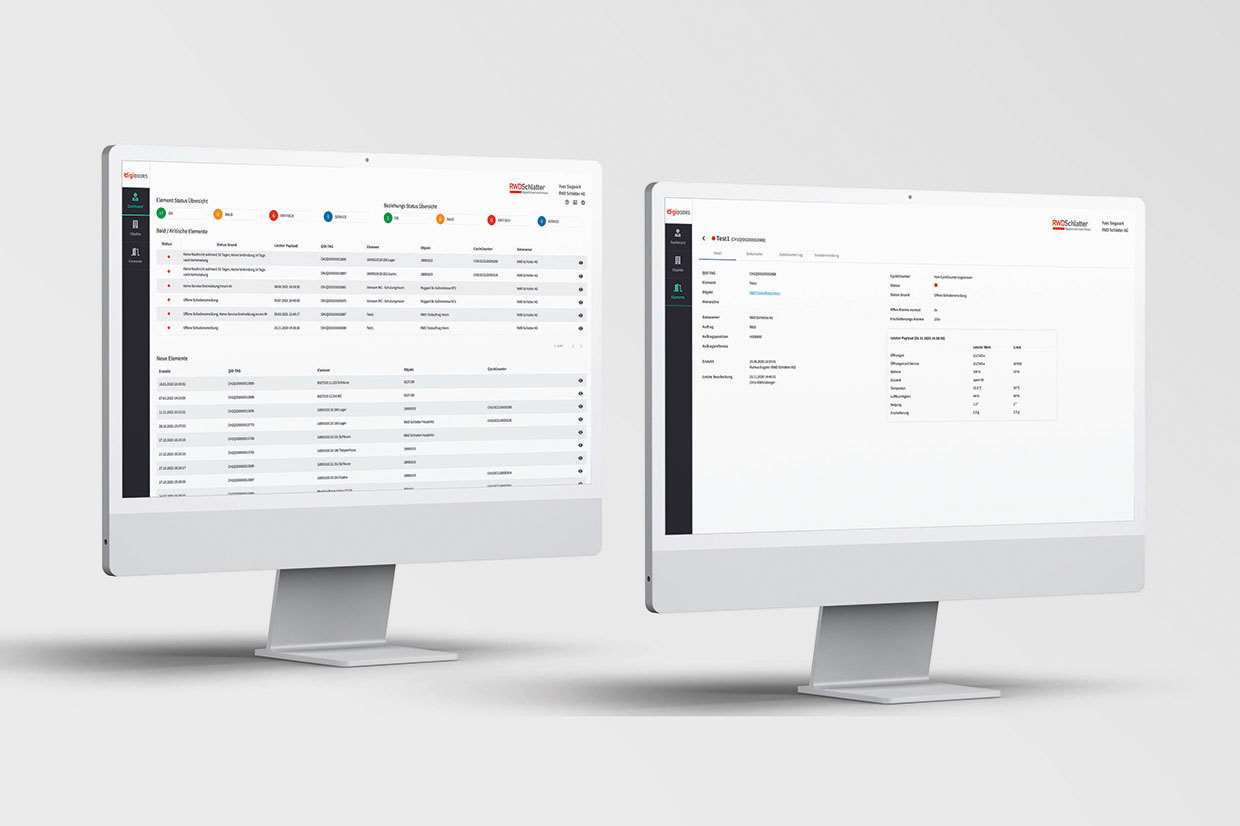

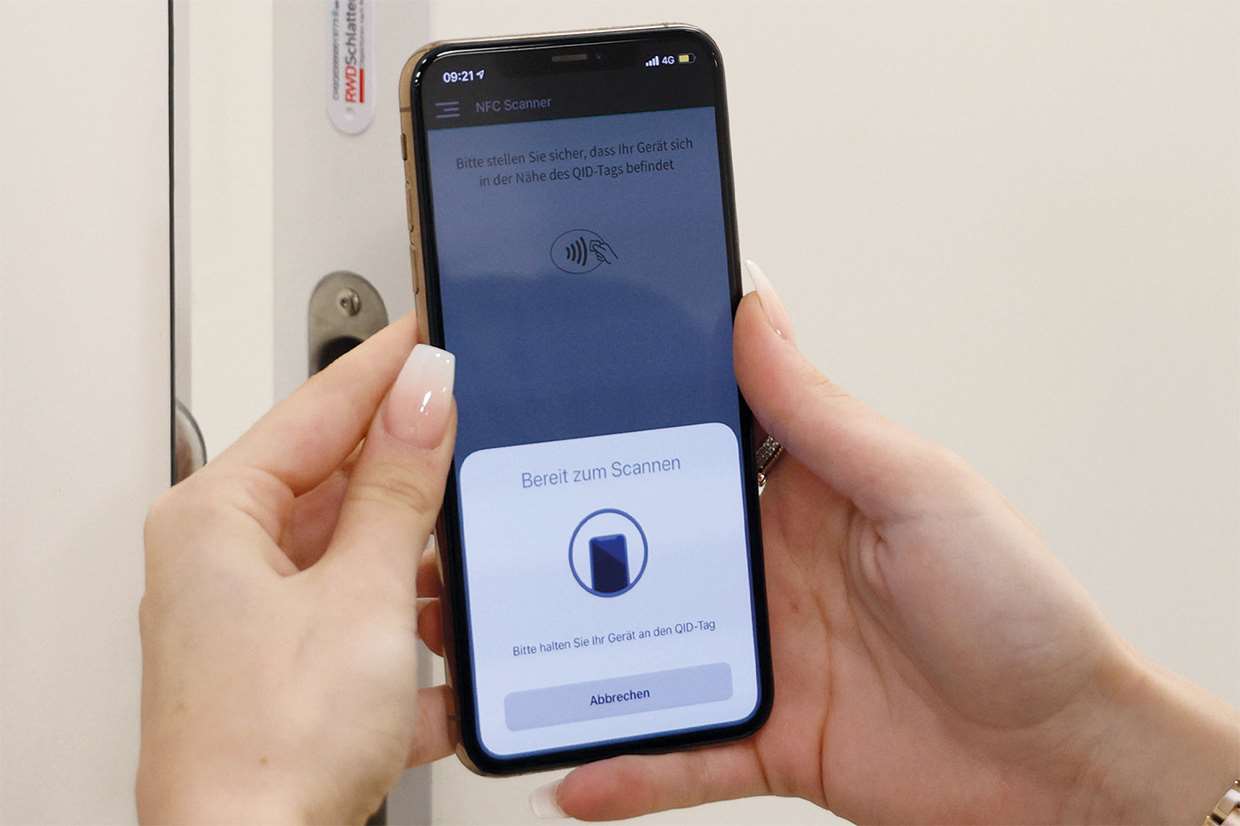

With the "digiDoors" tool, RWD Schlatter expanded the service offering for all its functional doors in the reporting year. Each RWD Schlatter functional door is now equipped with a QID-TAG and thus already digitised during production. This way, all information on all doors can be called up digitally at all times and quickly. This makes the handling of damages and maintenance highly efficient and eliminates unnecessary trips to determine the door type, the archival of documents, incorrect ordering of parts etc.

In early 2023, the companies Prüm and Garant will also put the new "DOORIT – The platform for doors" on the market. This allows more efficient cooperation with specialist trade partners in the areas of configuration, quotation preparation, and order processing. The new tool will give the division a clear potential for differentiation from the competition.

Outlook

Despite the challenging reporting year, the Doors Division is optimistic about the future. Germany, the most important market for the division, is expected to grow further over the long term in the new building segment due to the housing shortage, especially in metropolitan areas. A recovery is also expected in the renovation segment, since it is still necessary to replace a large number of doors that were installed after reunification and that have thus reached the end of their life cycle. The Swiss market is anticipated to remain stagnant at a high level and, like the Eastern European market, offers opportunities for increasing market shares further.

The division intends to make itself further independent of local electricity markets through targeted measures such as the accelerated expansion of photovoltaic systems as well as the new CHP systems at Prüm and Garant. The material prices have stabilised at a high level, so that construction projects can be realised again with greater planning security.

The last major investments in the two German production plants Prüm and Garant will significantly expand the capacities further and thus improve delivery times even more. The new logistics centre at the Swiss site Roggwil will additionally expand the specialist trade business in Switzerland.

The Doors Division will therefore continue to improve its processes and drive its high product quality and service orientation forward. The division thus sees itself in a good starting position for continued profitable growth.