Doors Division

The Doors Division consists of the two Business Units, Wood and Glass Solutions.

The Wood Solutions Business Unit, comprising the companies Prüm, Garant, Invado, RWD Schlatter and Joro, is one of Europe’s leading providers of interior wooden doors and frames. The business unit has five production sites: three in Germany and one each in Switzerland and Poland. In the domestic markets, it offers its customers a comprehensive range of products from standard doors to complex functional doors.

As a specialist for shower enclosures and glass systems, the Glass Solutions Business Unit offers impressive solutions for all generations, lifestyles and types of residences. Thanks to its strong brands Kermi, Koralle, Baduscho and Interwand, it is the market leader in Europe. In addition to the integrated production sites in Germany and the locally oriented manufacturing in Switzerland, it operates internationally through distribution companies.

Market trends

The Doors Division achieved revenues of CHF 501.6 million in the reporting year 2023, which corresponds to a decrease of 9.3% compared to the previous year (CHF 552.7 million). Organic growth (when adjusted for currency and acquisition effects) amounted to –8.2%. EBITDA with one-time effects fell by 33.9%, from CHF 59.2 million in the previous year to CHF 39.1 million. This corresponds to a decrease in the EBITDA margin from 10.7% to 7.8%. Without one-time effects, EBITDA fell by 33.5% from CHF 62.2 million to CHF 41.4 million. EBIT with one-time effects amounted to CHF 1.0 million (previous year: CHF 24.0 million, –95.8%). Without one-time effects, there was a 88.0% reduction from CHF 27.2 million in the previous year to CHF 3.3 million.

In 2023, the Doors Division continued to contend with a difficult market environment, primarily in Germany. On the one hand, it experienced a drastic volume decrease, mainly with standard doors in new construction as well as in renovation, which was caused by high construction material prices and interest rates. On the other hand, high energy costs had a noticeably negative impact.

The difficult market situation in the reporting year led to a record level of bankruptcies, which also affected door production suppliers, among others. For residential construction, a 25% decline in building permits compared to 2022 is expected for the reporting year. Since the time span from approval to completion is around 18 to 24 months, a decline in completions is therefore expected for 2024 as well. Non-residential construction is less affected due to public buildings; as a result, only an 11% decline in approvals compared to 2022 is anticipated in this segment in 2023.

The significant decline in residential construction in Germany, the most important market, had a disproportionate impact on the wholesale business, since trade customers reduced their inventory further due to lower demand and higher interest rates, with the aim of reducing their capital lockup. The lower demand of wholesalers also led to many small orders, which required more flexibility in production and led to additional costs in all areas of the company, from fulfilment to manufacturing to logistics. Despite this challenging market situation, Prüm and Garant were able to acquire further market shares in Germany. The market for interior doors in general declined by 21% in the first half of 2023 compared to the previous year; however, Prüm and Garant recorded a decrease of 18% by comparison.

Joro, which was acquired in 2022, looks back at a successful year. The wide product portfolio for fire protection and project business (specifically custom products for larger sizes) generally allowed the company to increase revenue compared to the previous year despite the market conditions. The company is currently operating at its capacity limit, which is why a capacity expansion is planned for the coming years.

A volume decrease was also felt in the Swiss market, but not to the same extent as in Germany, though. The new logistics centre at RWD Schlatter in Roggwil (CH), in which standard doors from Prüm, among other things, can be called up quickly, allowed the division to increase revenue with specialist partners. It was also possible to increase revenue via the new sales organisation in Western Switzerland.

The Polish company Invado positively changed its customer structure in the reporting year: It succeeded in entering the construction market and cooperating with selected wholesalers in Germany. In addition, it increased its revenue in Central Europe and in Italy.

As a result of the considerable volume decline, the Wood Solutions Business Unit initiated cost-saving measures, including reducing the headcount by around 300 employees. This mainly consisted of terminating temporary employment contracts and reducing expensive weekend shifts. Thanks to the initiated measures as well as slightly increasing volumes, the division was already able to record slight margin improvements in the fourth quarter of 2023.

The market for sanitary products suffered a further decline in 2023 due to the cost-related postponements of new construction projects and bathroom renovations. Furthermore, an extreme shortage of skilled workers, especially fitters, was intensified by the attractive funding situation for HVAC products and poses further difficulties for the sector. Glass products in particular are also affected by price increases, since their production is extremely energy-intensive. This trend will continue as long as high subsidies are paid for sustainable heat generators and the energy costs remain at this currently high level. In the Glass Solutions Business Unit, cost-savings programmes such as staff reduction were also initiated and structures adapted to compensate for the revenue decreases. In addition, it was possible to boost productivity further through increased efficiency. The revenue decline at Kermi in Germany and Bekon-Koralle in Switzerland also resulted in a revenue decline at Arbonia Glassysteme (formerly GVG) due to intercompany transactions.

In the current challenging times, the Doors Division strongly benefits from its long-standing, established distribution channels and customer relationships. In the reporting year, the division also succeeded in acquiring numerous new institutional customers, such as housing companies, for example. As a result of the new organisation of Arbonia Doors in Germany, it was possible to boost the project business of the Wood Solutions Business Unit and the Glass Solutions Business Unit, where its importance (for hotels, shipyards and prefabricated bathroom manu- facturers) is increasing. The cultivation of regional markets, such as in Western Switzerland, also promises further growth.

In October 2023, the Doors Division acquired Interwand. The company, which is located in Dörzbach (D), specialises in tailor-made manufacturing of glass partitions in the office area and offers a complete package of services for project business customers, from planning to production to assembly. In future, Interwand will procure glass from Arbonia Glassysteme, doors from Prüm and Joro, as well as fittings from Griffwerk and can use divisional synergies in the process. The Doors Division is expanding its product portfolio through this acquisition and obtains the opportunity to develop its project business and the office building segment.

Products, technology, and innovations

One of the most important differentiating features of doors is the edging technology, since the edging is the most technologically demanding part of door manufacturing. Furthermore, the door edge is also the most exposed part and is affected the most by damage (impacts). The innovative premium edge of Prüm and Garant was also able to gain further market shares in the reporting year and recorded further growth even in declining markets.

In the reporting year, RWD Schlatter put a new cast edging system into operation, which gives door profiles an edge coating made of polyurethane (plastics or synthetic resins). This technology ensures a particularly rugged edge formation in the case of higher requirements. It is used in particular with functional doors in heavily frequented buildings where components are subjected to especially high stresses. This is the case, for example, in hospitals, hotels, retirement and nursing homes, as well as schools.

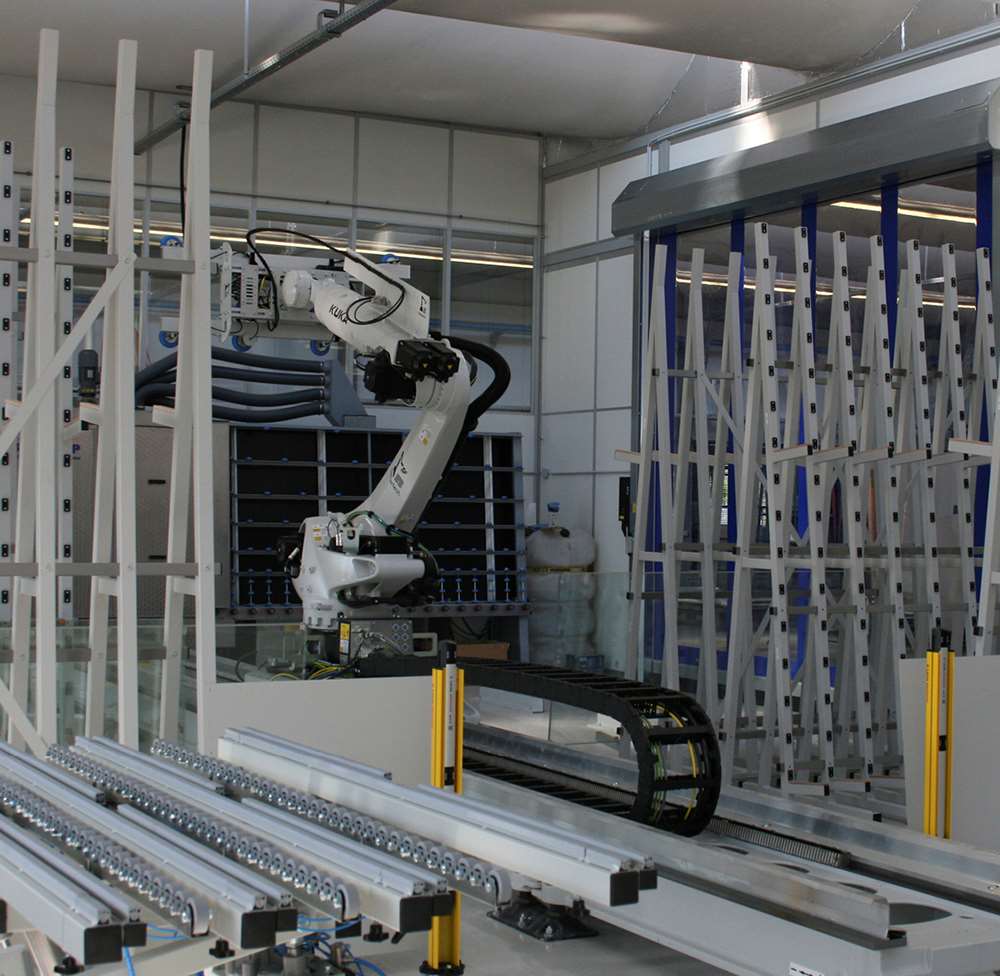

In the reporting year, the Doors Division recorded an investment volume of around CHF 57.3 million. A large part of this went into the last step for expanding the capacity of the two German production plants Prüm and Garant of the Wood Solutions Business Unit, and the largest portion was spent on the new drilling line at Garant and the two new combined heat and power plants (CHP) of Prüm and Garant. The CHP plant at Prüm is currently being ramped up and will be able to cover the complete heat generation as well as around 60% of the power requirements of the site starting in mid-2024. The construction of the CHP plant at Garant was able to start as planned. This plant will commence operations in 2025.

On the other hand, a significant share of the investments also went into IT and the digitisation of processes that take place at all sites. The division is still in the process of rolling out SAP S4/Hana throughout the division. Invado was already successfully changed over in 2022. The two companies Garant and Prüm are currently in the project phase, so that the go-live should take place in 2025 or 2026.

In 2023, the two companies Prüm and Garant also launched the new "DOORIT – The platform for doors". This allows more efficient cooperation with specialist trade partners in the areas of configuration, quotation preparation and order processing. This new tool, which will go live in 2024, will give the division a clear potential for differentiation from the competition.

The Glass Solutions Business Unit presented the innovative fastening technique KermiGLUE at the world’s leading sanitary trade fair ISH in Frankfurt (D). This makes it possible to glue wall profiles for shower enclosures on bathtubs onto the wall, thereby avoiding drilling work. The product is characterised by exceptional stability, fast and user-friendly assembly, as well as residue-free disassembly. This provides a distinct advantage especially for rental properties, since it does not damage the wall, unlike conventional fastening options.

Outlook

The year 2024 is expected to remain challenging for the Doors Division, since there is no prospect of the market conditions improving in the short term. The sharp decline in building permits is likely to result in further volume decreases. For this reason, the division has already taken various measures, largely in the wholesale business, to compensate for potential decreases. These measures include consistently driving expansion of the project business and export, for example.

In the medium term, however, the Doors Division is optimistic about the future. Germany, the most important market for the division, is expected to grow further in the new building segment due to the housing shortage, especially in metropolitan areas. Due to the war in Ukraine and the economic situation, a continued net immigration is expected in Germany, and the space requirement per person is also increasing. The German federal government has therefore confirmed its goal of building 400 000 homes yearly. A recovery is also expected in the renovation segment, since it is still necessary to replace a large number of doors that were installed after reunification and that have thus reached the end of their life cycle. Additionally, the housing stock in general is continually growing. Since the backlog of housing demand cannot be processed at the necessary speed, this will drive renovation forward.

The Swiss market is anticipated to stagnate at a high level and, like the Eastern European markets, offers opportunities for increasing market shares further.